|

|

|

Children with strabismus (crossed eyes) can be treated. They are not able to outgrow this condition on their own, but with help, it can be more easily corrected at a younger age. It is important for infants to have eye examinations as early as possible in their development and then another at age 2 years.

There are more sensory neurons in the tongue than in any other part of the body.

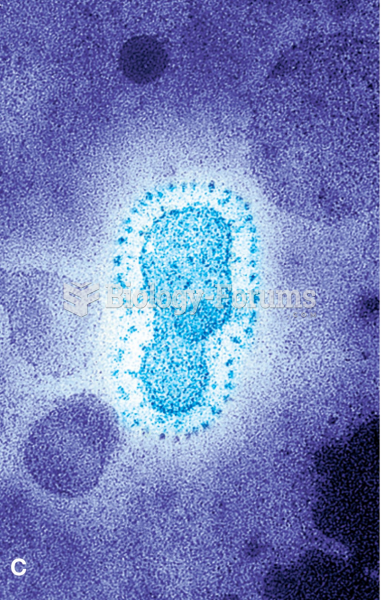

A seasonal flu vaccine is the best way to reduce the chances you will get seasonal influenza and spread it to others.

Though newer “smart” infusion pumps are increasingly becoming more sophisticated, they cannot prevent all programming and administration errors. Health care professionals that use smart infusion pumps must still practice the rights of medication administration and have other professionals double-check all high-risk infusions.

The first oral chemotherapy drug for colon cancer was approved by FDA in 2001.