|

|

|

About 3.2 billion people, nearly half the world population, are at risk for malaria. In 2015, there are about 214 million malaria cases and an estimated 438,000 malaria deaths.

The calories found in one piece of cherry cheesecake could light a 60-watt light bulb for 1.5 hours.

Nearly all drugs pass into human breast milk. How often a drug is taken influences the amount of drug that will pass into the milk. Medications taken 30 to 60 minutes before breastfeeding are likely to be at peak blood levels when the baby is nursing.

When Gabriel Fahrenheit invented the first mercury thermometer, he called "zero degrees" the lowest temperature he was able to attain with a mixture of ice and salt. For the upper point of his scale, he used 96°, which he measured as normal human body temperature (we know it to be 98.6° today because of more accurate thermometers).

In women, pharmacodynamic differences include increased sensitivity to (and increased effectiveness of) beta-blockers, opioids, selective serotonin reuptake inhibitors, and typical antipsychotics.

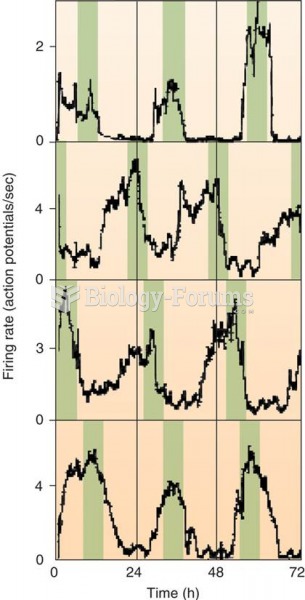

Firing Rate of Individual SCN Neurons in a Tissue Culture Color bars have been added to emphasize th

Firing Rate of Individual SCN Neurons in a Tissue Culture Color bars have been added to emphasize th

In 2008, the U.S. economy suffered a gaping wound as several trillion dollars were ripped out of it.

In 2008, the U.S. economy suffered a gaping wound as several trillion dollars were ripped out of it.