|

|

|

For pediatric patients, intravenous fluids are the most commonly cited products involved in medication errors that are reported to the USP.

About 100 new prescription or over-the-counter drugs come into the U.S. market every year.

During pregnancy, a woman is more likely to experience bleeding gums and nosebleeds caused by hormonal changes that increase blood flow to the mouth and nose.

Aspirin may benefit 11 different cancers, including those of the colon, pancreas, lungs, prostate, breasts, and leukemia.

About 60% of newborn infants in the United States are jaundiced; that is, they look yellow. Kernicterus is a form of brain damage caused by excessive jaundice. When babies begin to be affected by excessive jaundice and begin to have brain damage, they become excessively lethargic.

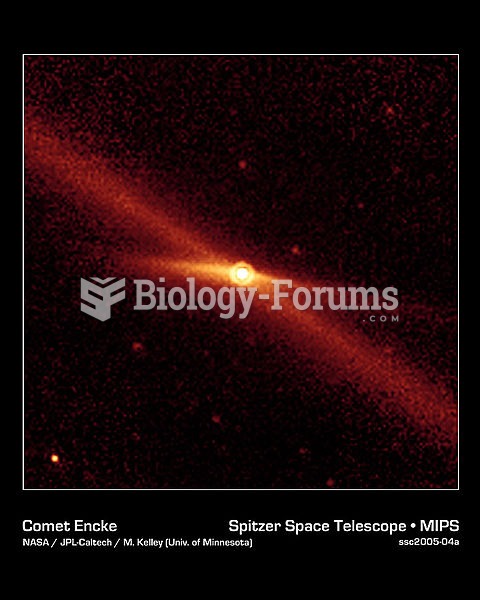

the comet Encke riding along its pebbly trail of debris (long diagonal line) between the orbits of M

the comet Encke riding along its pebbly trail of debris (long diagonal line) between the orbits of M

Three days after the Boston Marathon explosion, the FBI released this photograph that had been taken

Three days after the Boston Marathon explosion, the FBI released this photograph that had been taken