|

|

|

Side effects from substance abuse include nausea, dehydration, reduced productivitiy, and dependence. Though these effects usually worsen over time, the constant need for the substance often overcomes rational thinking.

The tallest man ever known was Robert Wadlow, an American, who reached the height of 8 feet 11 inches. He died at age 26 years from an infection caused by the immense weight of his body (491 pounds) and the stress on his leg bones and muscles.

Excessive alcohol use costs the country approximately $235 billion every year.

The people with the highest levels of LDL are Mexican American males and non-Hispanic black females.

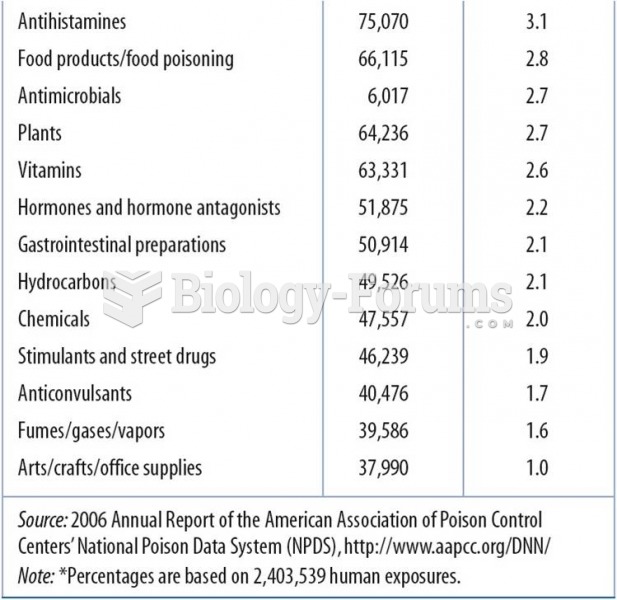

Acetaminophen (Tylenol) in overdose can seriously damage the liver. It should never be taken by people who use alcohol heavily; it can result in severe liver damage and even a condition requiring a liver transplant.

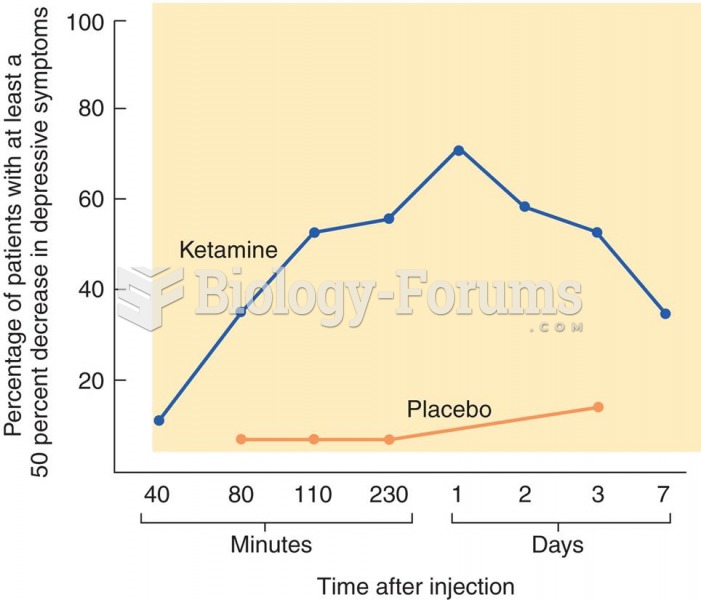

Treatment of Depression with Ketamine The graph shows the effects of ketamine on symptoms of depress

Treatment of Depression with Ketamine The graph shows the effects of ketamine on symptoms of depress

J. P. Morgan, the financial genius, staved off ruinous competition among steel firms by combining mo

J. P. Morgan, the financial genius, staved off ruinous competition among steel firms by combining mo