This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

More than 34,000 trademarked medication names and more than 10,000 generic medication names are in use in the United States.

Did you know?

When blood is exposed to air, it clots. Heparin allows the blood to come in direct contact with air without clotting.

Did you know?

Symptoms of kidney problems include a loss of appetite, back pain (which may be sudden and intense), chills, abdominal pain, fluid retention, nausea, the urge to urinate, vomiting, and fever.

Did you know?

The longest a person has survived after a heart transplant is 24 years.

Did you know?

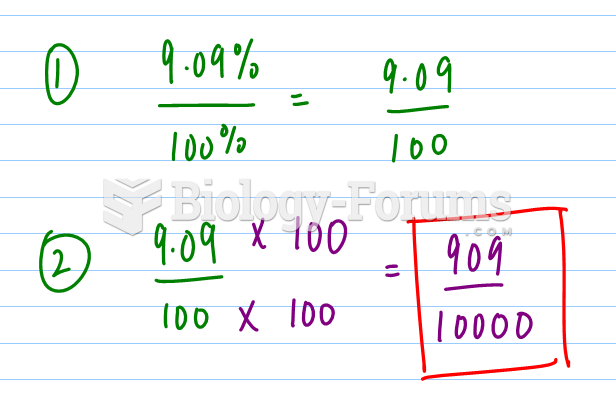

The ratio of hydrogen atoms to oxygen in water (H2O) is 2:1.