|

|

|

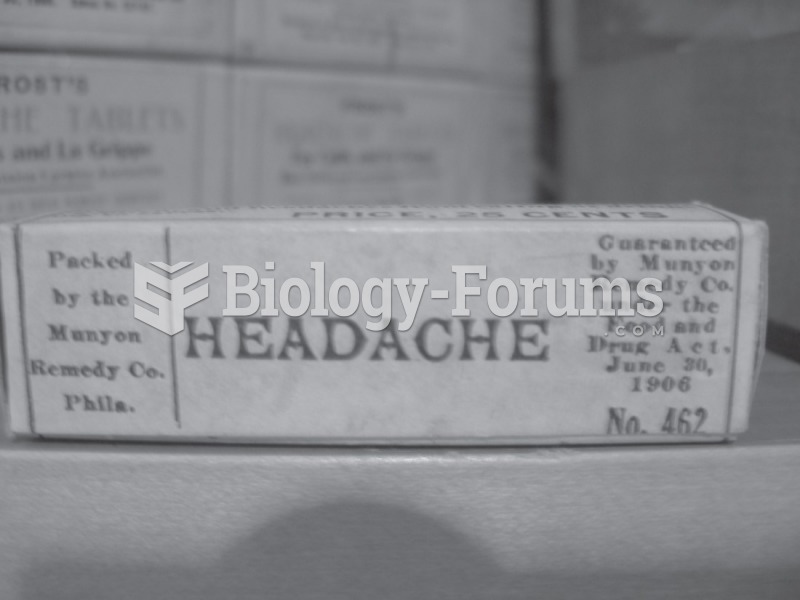

The use of salicylates dates back 2,500 years to Hippocrates’s recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

Long-term mental and physical effects from substance abuse include: paranoia, psychosis, immune deficiencies, and organ damage.

The Babylonians wrote numbers in a system that used 60 as the base value rather than the number 10. They did not have a symbol for "zero."

Illness; diuretics; laxative abuse; hot weather; exercise; sweating; caffeine; alcoholic beverages; starvation diets; inadequate carbohydrate consumption; and diets high in protein, salt, or fiber can cause people to become dehydrated.

Acetaminophen (Tylenol) in overdose can seriously damage the liver. It should never be taken by people who use alcohol heavily; it can result in severe liver damage and even a condition requiring a liver transplant.