|

|

|

Calcitonin is a naturally occurring hormone. In women who are at least 5 years beyond menopause, it slows bone loss and increases spinal bone density.

Chronic marijuana use can damage the white blood cells and reduce the immune system's ability to respond to disease by as much as 40%. Without a strong immune system, the body is vulnerable to all kinds of degenerative and infectious diseases.

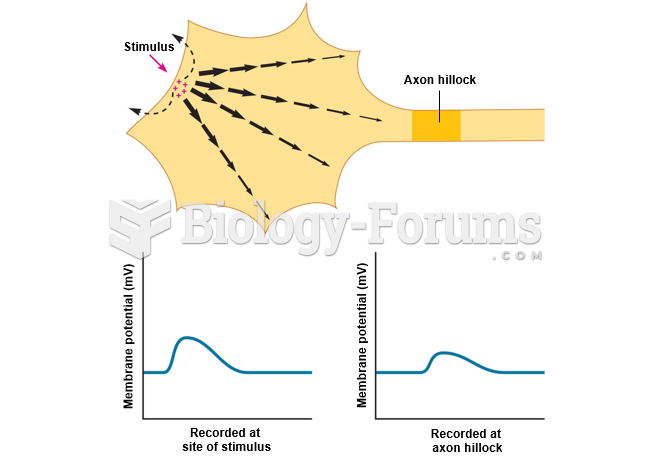

Multiple sclerosis is a condition wherein the body's nervous system is weakened by an autoimmune reaction that attacks the myelin sheaths of neurons.

If all the neurons in the human body were lined up, they would stretch more than 600 miles.

Certain rare plants containing cyanide include apricot pits and a type of potato called cassava. Fortunately, only chronic or massive ingestion of any of these plants can lead to serious poisoning.