|

| Previous Image | Next Image |

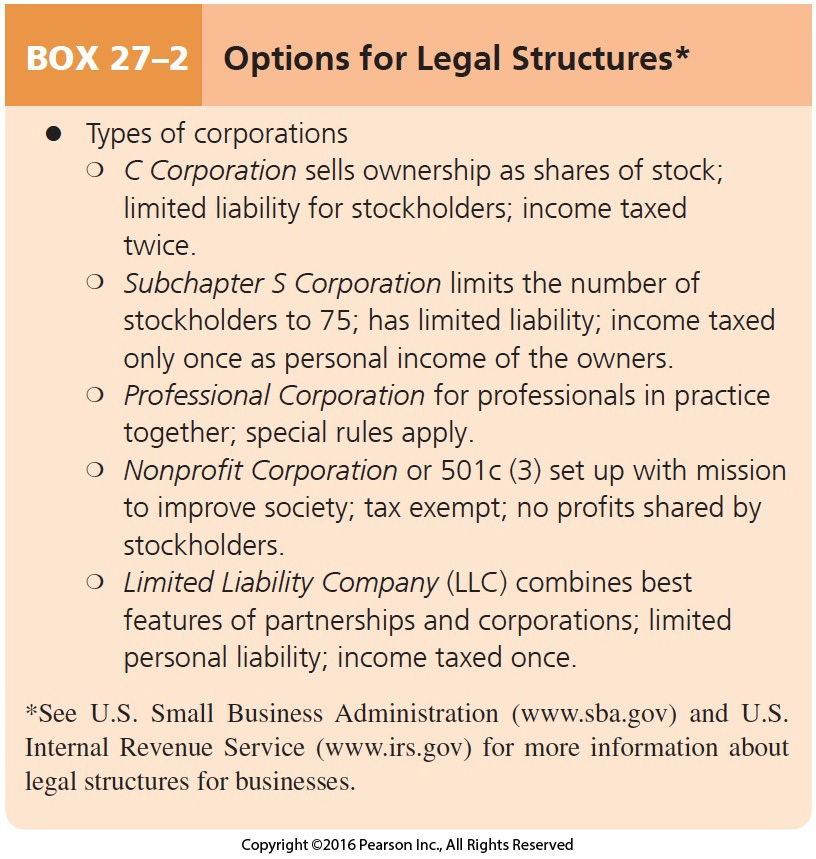

| Description: Options for Legal Structures* 0 Types of corporations 0 O O O O C Corporation sells ownership as shares of stock; limited liability for stockholders; income taxed twice. Subchapters Corporation limits the number of stockholders to 75; has limited liability; income taxed only once as personal income of the owners. Professional Corporation for professionals in practice together; special rules apply. Nonprofit Corporation or 501 c (3) set up with mission to improve society; tax exempt; no profits shared by stockholders. Limited Liability Company (LLC) combines best features of partnerships and corporations; limited personal liability; income taxed once. *See US, Small Business Administration (wwwsbagov) and US. Internal Revenue Service (wwwirsgov) for more information about legal structures for businesses.

Picture Stats: Views: 544 Filesize: 284.25kB Height: 859 Width: 816 Source: https://biology-forums.com/index.php?action=gallery;sa=view;id=33615 |