|

|

|

IgA antibodies protect body surfaces exposed to outside foreign substances. IgG antibodies are found in all body fluids. IgM antibodies are the first type of antibody made in response to an infection. IgE antibody levels are often high in people with allergies. IgD antibodies are found in tissues lining the abdomen and chest.

To maintain good kidney function, you should drink at least 3 quarts of water daily. Water dilutes urine and helps prevent concentrations of salts and minerals that can lead to kidney stone formation. Chronic dehydration is a major contributor to the development of kidney stones.

During the twentieth century, a variant of the metric system was used in Russia and France in which the base unit of mass was the tonne. Instead of kilograms, this system used millitonnes (mt).

The FDA recognizes 118 routes of administration.

Amphetamine poisoning can cause intravascular coagulation, circulatory collapse, rhabdomyolysis, ischemic colitis, acute psychosis, hyperthermia, respiratory distress syndrome, and pericarditis.

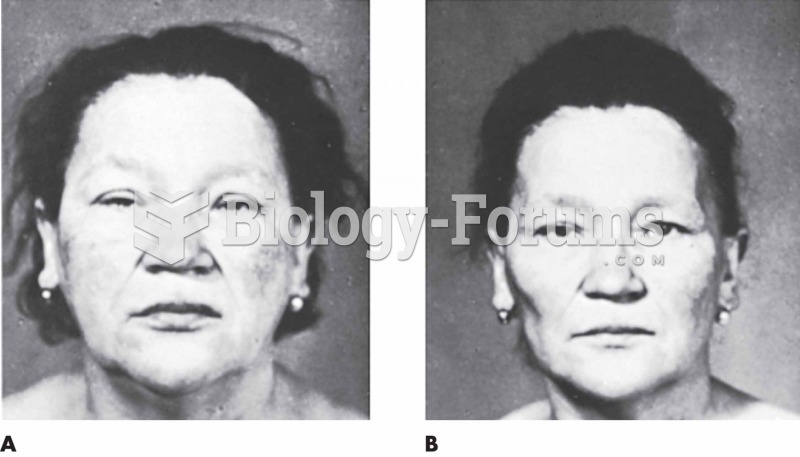

(A) A 62-year-old patient with myxedema exhibiting marked edema of the face and a somnolent look. Th

(A) A 62-year-old patient with myxedema exhibiting marked edema of the face and a somnolent look. Th

On March 25, 1911, as scores of young factory girls leaped to their deaths from the eighth, ninth, a

On March 25, 1911, as scores of young factory girls leaped to their deaths from the eighth, ninth, a