|

|

|

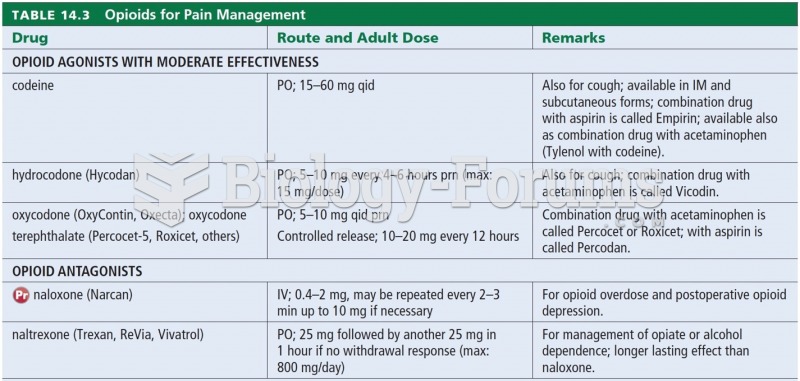

Computer programs are available that crosscheck a new drug's possible trade name with all other trade names currently available. These programs detect dangerous similarities between names and alert the manufacturer of the drug.

More than nineteen million Americans carry the factor V gene that causes blood clots, pulmonary embolism, and heart disease.

Prostaglandins were first isolated from human semen in Sweden in the 1930s. They were so named because the researcher thought that they came from the prostate gland. In fact, prostaglandins exist and are synthesized in almost every cell of the body.

Dogs have been used in studies to detect various cancers in human subjects. They have been trained to sniff breath samples from humans that were collected by having them breathe into special tubes. These people included 55 lung cancer patients, 31 breast cancer patients, and 83 cancer-free patients. The dogs detected 54 of the 55 lung cancer patients as having cancer, detected 28 of the 31 breast cancer patients, and gave only three false-positive results (detecting cancer in people who didn't have it).

If all the neurons in the human body were lined up, they would stretch more than 600 miles.