|

|

|

Though “Krazy Glue” or “Super Glue” has the ability to seal small wounds, it is not recommended for this purpose since it contains many substances that should not enter the body through the skin, and may be harmful.

A serious new warning has been established for pregnant women against taking ACE inhibitors during pregnancy. In the study, the risk of major birth defects in children whose mothers took ACE inhibitors during the first trimester was nearly three times higher than in children whose mothers didn't take ACE inhibitors. Physicians can prescribe alternative medications for pregnant women who have symptoms of high blood pressure.

The most common treatment options for addiction include psychotherapy, support groups, and individual counseling.

Inotropic therapy does not have a role in the treatment of most heart failure patients. These drugs can make patients feel and function better but usually do not lengthen the predicted length of their lives.

When taking monoamine oxidase inhibitors, people should avoid a variety of foods, which include alcoholic beverages, bean curd, broad (fava) bean pods, cheese, fish, ginseng, protein extracts, meat, sauerkraut, shrimp paste, soups, and yeast.

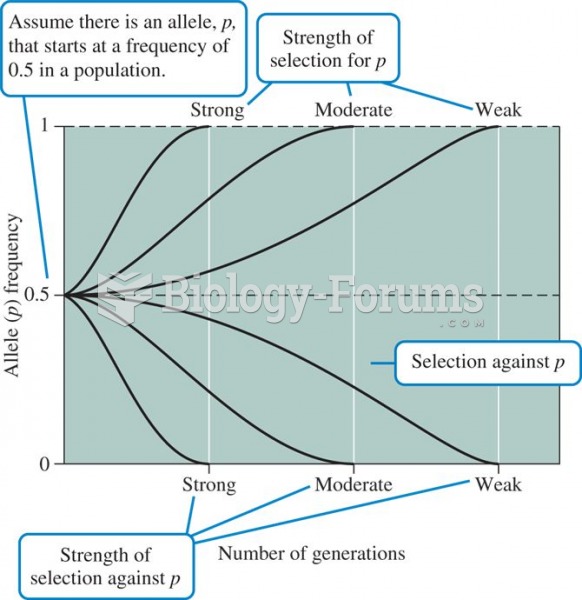

Variation in the rate of evolution as a function of the strength of selection, assuming genetic drif

Variation in the rate of evolution as a function of the strength of selection, assuming genetic drif

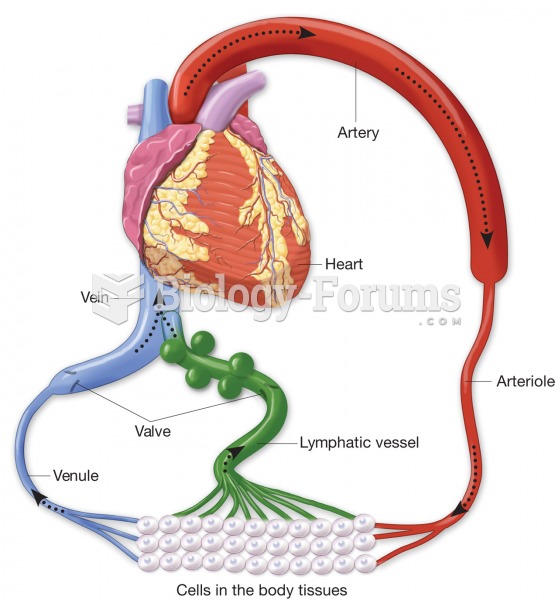

Lymphatic vessels (green) pick up excess tissue fluid, purify it in lymph nodes, and return it to th

Lymphatic vessels (green) pick up excess tissue fluid, purify it in lymph nodes, and return it to th