|

|

|

There are more sensory neurons in the tongue than in any other part of the body.

Nearly 31 million adults in America have a total cholesterol level that is more than 240 mg per dL.

HIV testing reach is still limited. An estimated 40% of people with HIV (more than 14 million) remain undiagnosed and do not know their infection status.

Aspirin is the most widely used drug in the world. It has even been recognized as such by the Guinness Book of World Records.

The top 10 most important tips that will help you grow old gracefully include (1) quit smoking, (2) keep your weight down, (3) take supplements, (4) skip a meal each day or fast 1 day per week, (5) get a pet, (6) get medical help for chronic pain, (7) walk regularly, (8) reduce arguments, (9) put live plants in your living space, and (10) do some weight training.

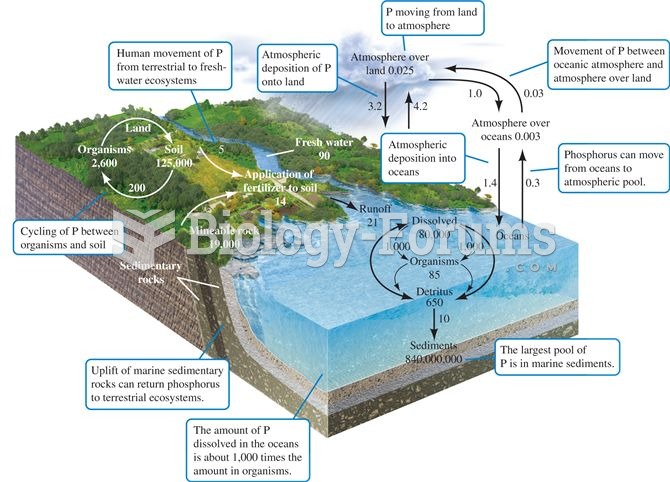

The phosphorus cycle. Numbers are 1012 g P or fluxes as 1012 g P per year (data from Schlesinger 199

The phosphorus cycle. Numbers are 1012 g P or fluxes as 1012 g P per year (data from Schlesinger 199

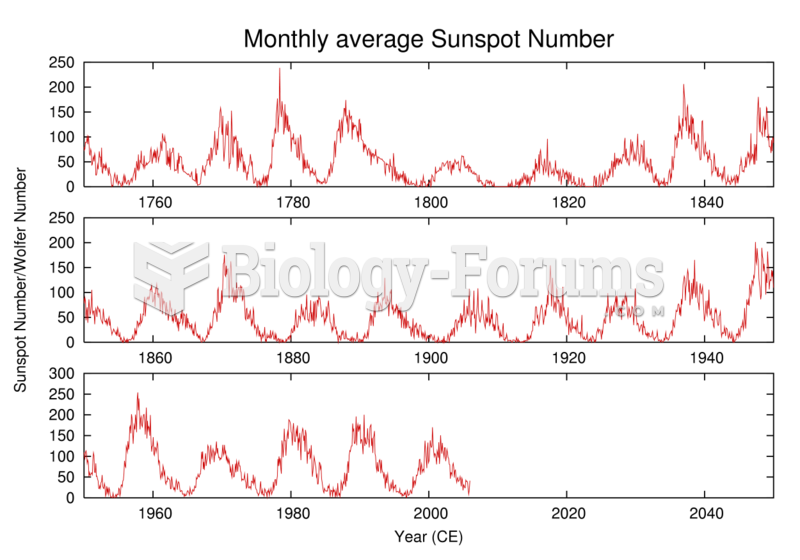

History of the number of observed sunspots during the last 250 years, which shows the ~11-year solar

History of the number of observed sunspots during the last 250 years, which shows the ~11-year solar