|

|

|

Although the Roman numeral for the number 4 has always been taught to have been "IV," according to historians, the ancient Romans probably used "IIII" most of the time. This is partially backed up by the fact that early grandfather clocks displayed IIII for the number 4 instead of IV. Early clockmakers apparently thought that the IIII balanced out the VIII (used for the number 8) on the clock face and that it just looked better.

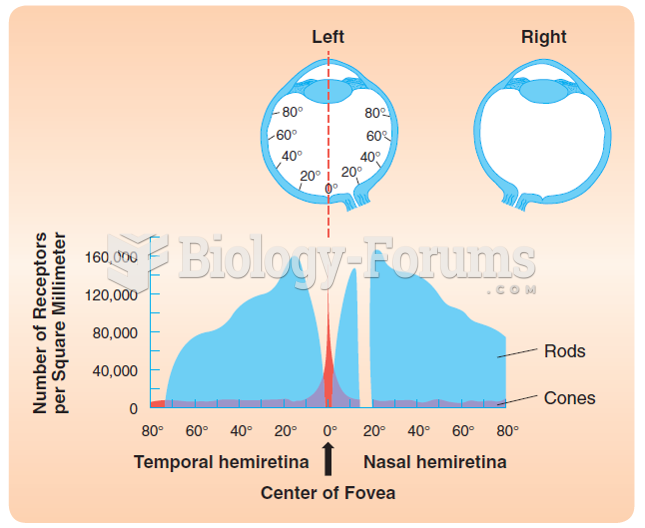

People who have myopia, or nearsightedness, are not able to see objects at a distance but only up close. It occurs when the cornea is either curved too steeply, the eye is too long, or both. This condition is progressive and worsens with time. More than 100 million people in the United States are nearsighted, but only 20% of those are born with the condition. Diet, eye exercise, drug therapy, and corrective lenses can all help manage nearsightedness.

The most destructive flu epidemic of all times in recorded history occurred in 1918, with approximately 20 million deaths worldwide.

Eating food that has been cooked with poppy seeds may cause you to fail a drug screening test, because the seeds contain enough opiate alkaloids to register as a positive.

You should not take more than 1,000 mg of vitamin E per day. Doses above this amount increase the risk of bleeding problems that can lead to a stroke.