|

|

|

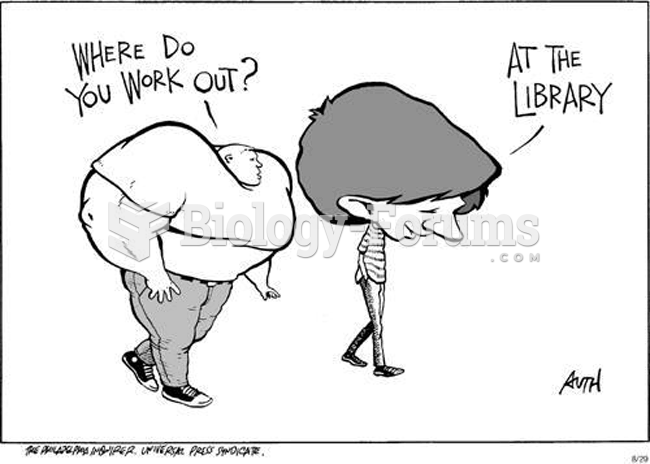

The top 10 most important tips that will help you grow old gracefully include (1) quit smoking, (2) keep your weight down, (3) take supplements, (4) skip a meal each day or fast 1 day per week, (5) get a pet, (6) get medical help for chronic pain, (7) walk regularly, (8) reduce arguments, (9) put live plants in your living space, and (10) do some weight training.

Interferon was scarce and expensive until 1980, when the interferon gene was inserted into bacteria using recombinant DNA technology, allowing for mass cultivation and purification from bacterial cultures.

In most cases, kidneys can recover from almost complete loss of function, such as in acute kidney (renal) failure.

During the twentieth century, a variant of the metric system was used in Russia and France in which the base unit of mass was the tonne. Instead of kilograms, this system used millitonnes (mt).

Dogs have been used in studies to detect various cancers in human subjects. They have been trained to sniff breath samples from humans that were collected by having them breathe into special tubes. These people included 55 lung cancer patients, 31 breast cancer patients, and 83 cancer-free patients. The dogs detected 54 of the 55 lung cancer patients as having cancer, detected 28 of the 31 breast cancer patients, and gave only three false-positive results (detecting cancer in people who didn't have it).