This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

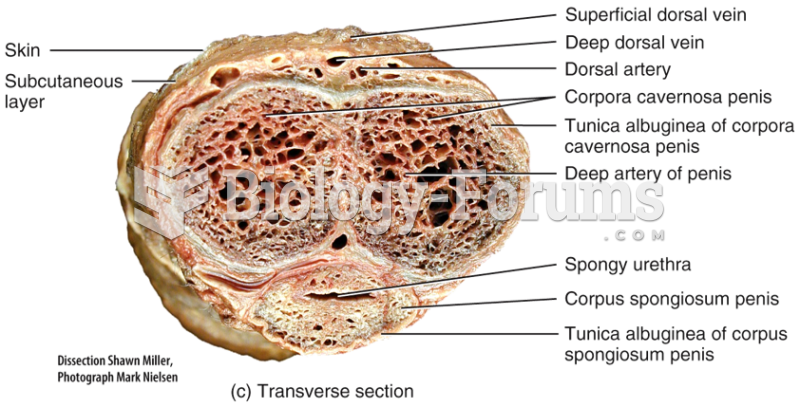

There are 20 feet of blood vessels in each square inch of human skin.

Did you know?

No drugs are available to relieve parathyroid disease. Parathyroid disease is caused by a parathyroid tumor, and it needs to be removed by surgery.

Did you know?

Green tea is able to stop the scent of garlic or onion from causing bad breath.

Did you know?

Nitroglycerin is used to alleviate various heart-related conditions, and it is also the chief component of dynamite (but mixed in a solid clay base to stabilize it).

Did you know?

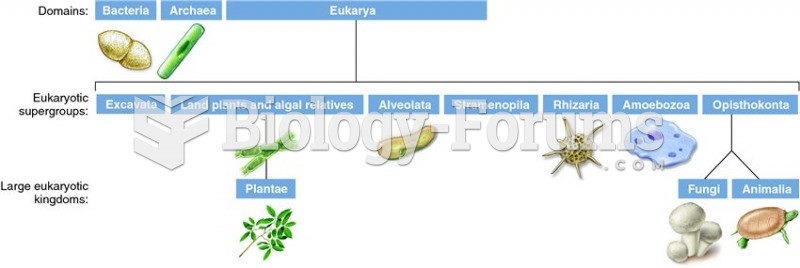

Bacteria have flourished on the earth for over three billion years. They were the first life forms on the planet.