|

|

|

The average older adult in the United States takes five prescription drugs per day. Half of these drugs contain a sedative. Alcohol should therefore be avoided by most senior citizens because of the dangerous interactions between alcohol and sedatives.

Nearly all drugs pass into human breast milk. How often a drug is taken influences the amount of drug that will pass into the milk. Medications taken 30 to 60 minutes before breastfeeding are likely to be at peak blood levels when the baby is nursing.

Cancer has been around as long as humankind, but only in the second half of the twentieth century did the number of cancer cases explode.

There are actually 60 minerals, 16 vitamins, 12 essential amino acids, and three essential fatty acids that your body needs every day.

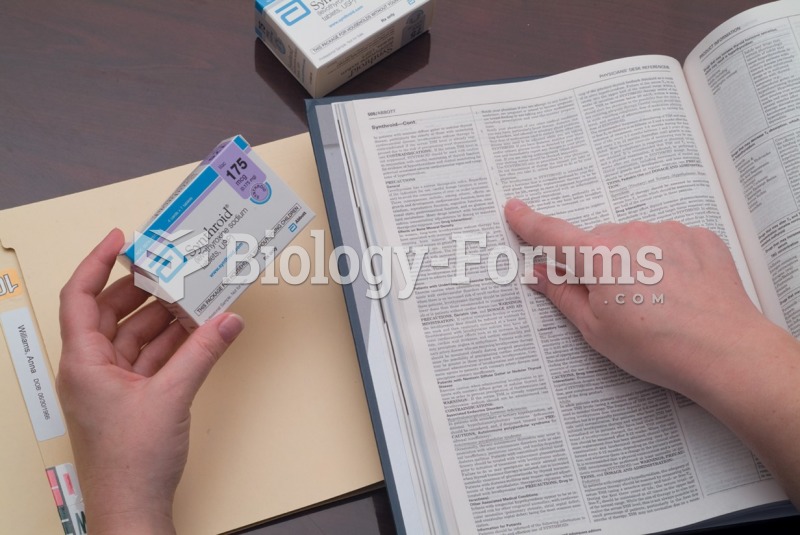

Recent studies have shown that the number of medication errors increases in relation to the number of orders that are verified per pharmacist, per work shift.