|

| Previous Image | Next Image |

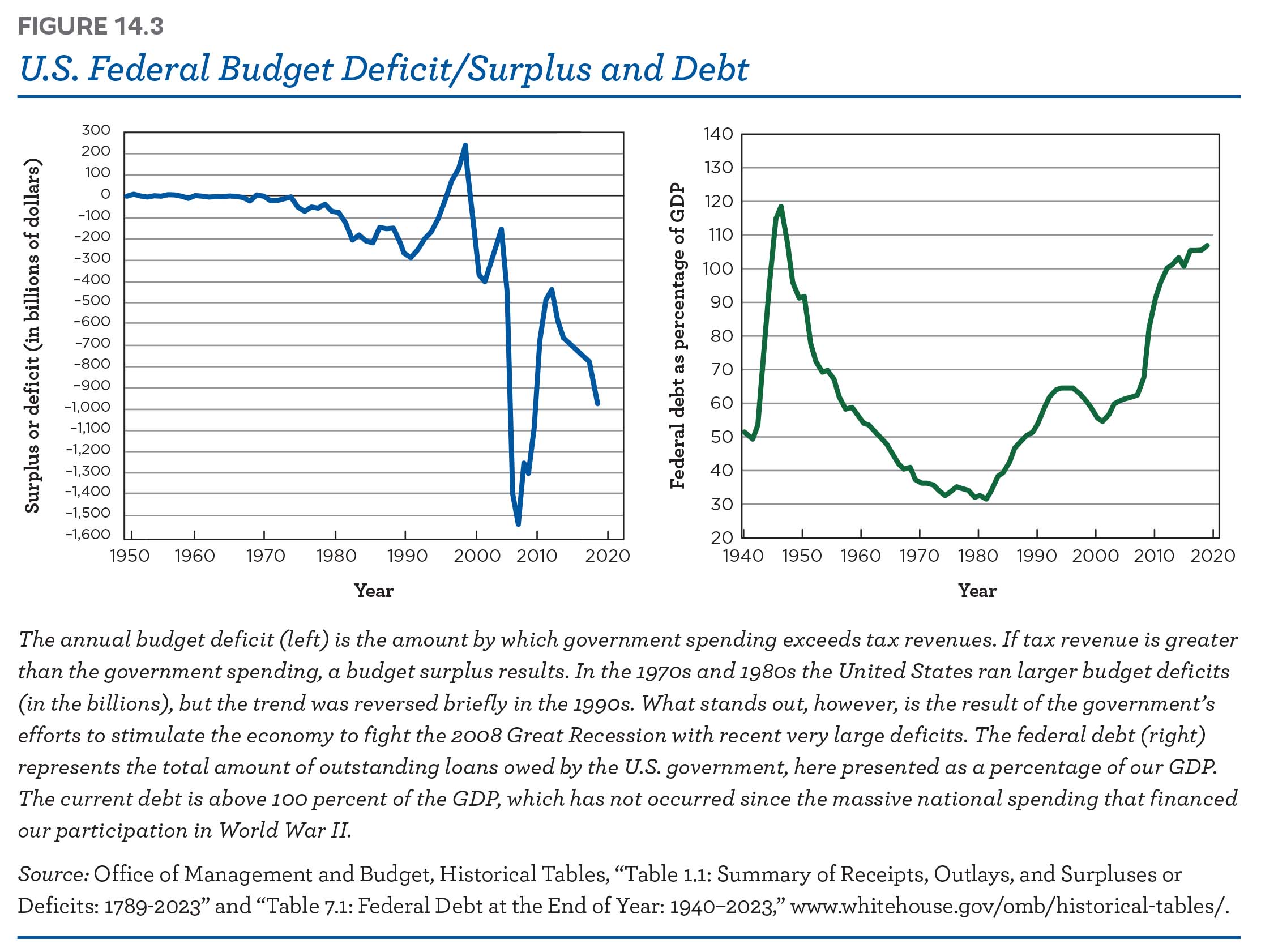

| Description: FIGURE 14.3 US. Federal Budget Deficit/Surplus and Debt 300 140 200 E 100 130 a o n. = Q 120 .g —100 0 ‘ '45 —200 ”6 110 l m —3oo 1’ U) A g —400 g 100 E —500 5 90 -: —600 2 :7, —700 8. 80 H _ (I) '8 800 a, 70 .3;- —900 5 -8 —1,000 .3 60 g —1,100 7-,, 50 3 —1,200 ’6 '3'. —1,300 '3 4O ‘5 —1,400 "" ”3 4,500 30 —1,600 20 1950 1960 1970 1980 1990 2000 2010 2020 1940 1950 1960 1970 1980 1990 2000 2010 2020 Year Year The annual budget deficit (left) is the amount by which government spending exceeds tax revenues. If tax revenue is greater than the government spending, a budget surplus results. In the 1970s and 1980s the United States ran larger budget deficits (in the billions), but the trend was reversed briefly in the 1990s. What stands out, however, is the result ofthe government’s efforts to stimulate the economy to fight the 2008 Great Recession with recent very large deficits. The federal debt (right) represents the total amount ofoutstanding loans owed by the US. government, here presented as apercentage ofour GDP. The current debt is above 100 percent of the GDP, which has not occurred since the massive national spending that financed ourparticipation in World War II. Source: Office of Management and Budget, Historical Tables, “Table 1.1: Summary of Receipts, Outlays, and Surpluses or Deficits: 1789-2023” and “Table 7.1: Federal Debt at the End of Year: 1940-2023,” wwwwhitehouse.gov/omb/historical-tables/.

Picture Stats: Views: 795 Filesize: 397.03kB Height: 1681 Width: 2227 Source: https://biology-forums.com/index.php?action=gallery;sa=view;id=46802 |