|

|

|

Patients should never assume they are being given the appropriate drugs. They should make sure they know which drugs are being prescribed, and always double-check that the drugs received match the prescription.

Blood is approximately twice as thick as water because of the cells and other components found in it.

Acetaminophen (Tylenol) in overdose can seriously damage the liver. It should never be taken by people who use alcohol heavily; it can result in severe liver damage and even a condition requiring a liver transplant.

The average older adult in the United States takes five prescription drugs per day. Half of these drugs contain a sedative. Alcohol should therefore be avoided by most senior citizens because of the dangerous interactions between alcohol and sedatives.

Approximately 70% of expectant mothers report experiencing some symptoms of morning sickness during the first trimester of pregnancy.

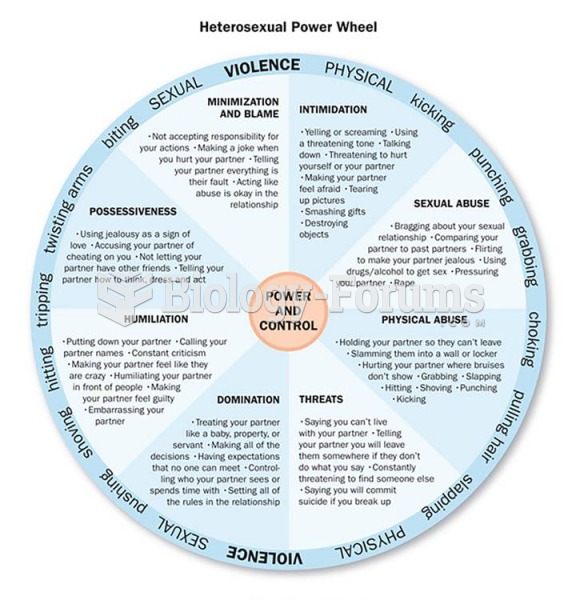

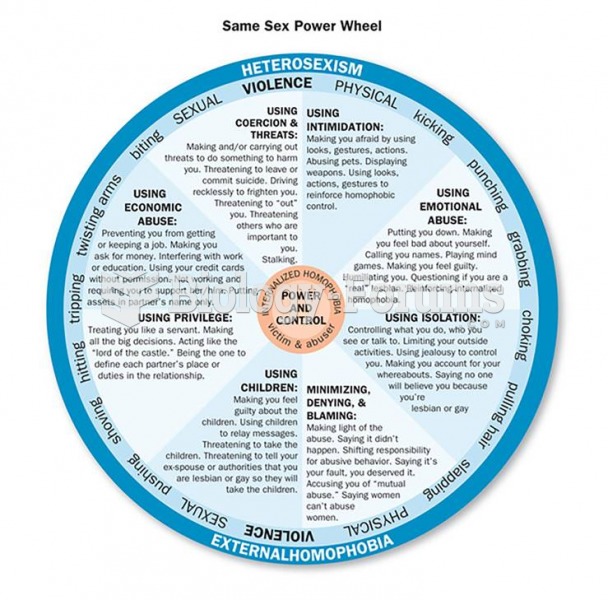

The Power and Control Wheels of Abusive Relationships When one person in a relationship repeatedly ...

The Power and Control Wheels of Abusive Relationships When one person in a relationship repeatedly ...

The Power and Control Wheels of Abusive Relationships When one person in a relationship repeatedly ...

The Power and Control Wheels of Abusive Relationships When one person in a relationship repeatedly ...

Redrape the back, face the head of the table, and apply passive touch as finishing technique. Gently ...

Redrape the back, face the head of the table, and apply passive touch as finishing technique. Gently ...