|

|

|

Throughout history, plants containing cardiac steroids have been used as heart drugs and as poisons (e.g., in arrows used in combat), emetics, and diuretics.

Never take aspirin without food because it is likely to irritate your stomach. Never give aspirin to children under age 12. Overdoses of aspirin have the potential to cause deafness.

Most fungi that pathogenically affect humans live in soil. If a person is not healthy, has an open wound, or is immunocompromised, a fungal infection can be very aggressive.

A seasonal flu vaccine is the best way to reduce the chances you will get seasonal influenza and spread it to others.

Stroke kills people from all ethnic backgrounds, but the people at highest risk for fatal strokes are: black men, black women, Asian men, white men, and white women.

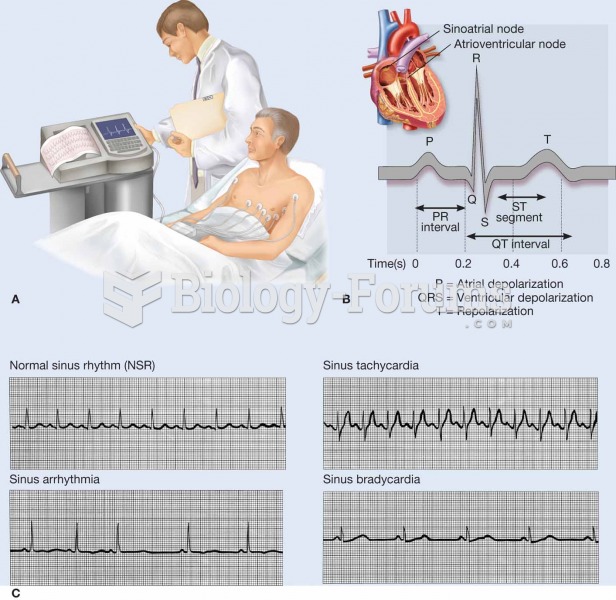

An electrocardiogram (ECG, EKG) is a commonly used procedure in which the electrical events associat

An electrocardiogram (ECG, EKG) is a commonly used procedure in which the electrical events associat

Behavior modification has been useful in raising the amount of social responding by children with ...

Behavior modification has been useful in raising the amount of social responding by children with ...