|

|

|

Hypertension is a silent killer because it is deadly and has no significant early symptoms. The danger from hypertension is the extra load on the heart, which can lead to hypertensive heart disease and kidney damage. This occurs without any major symptoms until the high blood pressure becomes extreme. Regular blood pressure checks are an important method of catching hypertension before it can kill you.

Autoimmune diseases occur when the immune system destroys its own healthy tissues. When this occurs, white blood cells cannot distinguish between pathogens and normal cells.

As of mid-2016, 18.2 million people were receiving advanced retroviral therapy (ART) worldwide. This represents between 43–50% of the 34–39.8 million people living with HIV.

Fatal fungal infections may be able to resist newer antifungal drugs. Globally, fungal infections are often fatal due to the lack of access to multiple antifungals, which may be required to be utilized in combination. Single antifungals may not be enough to stop a fungal infection from causing the death of a patient.

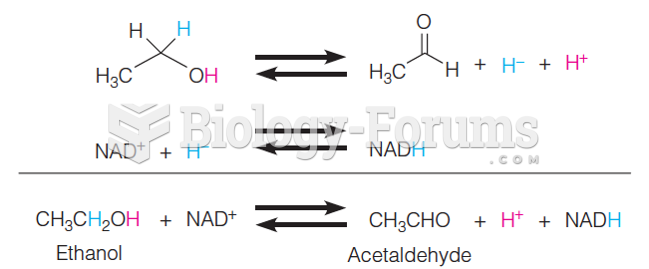

People with alcoholism are at a much greater risk of malnutrition than are other people and usually exhibit low levels of most vitamins (especially folic acid). This is because alcohol often takes the place of 50% of their daily intake of calories, with little nutritional value contained in it.