|

|

|

As of mid-2016, 18.2 million people were receiving advanced retroviral therapy (ART) worldwide. This represents between 43–50% of the 34–39.8 million people living with HIV.

Astigmatism is the most common vision problem. It may accompany nearsightedness or farsightedness. It is usually caused by an irregularly shaped cornea, but sometimes it is the result of an irregularly shaped lens. Either type can be corrected by eyeglasses, contact lenses, or refractive surgery.

Approximately 15–25% of recognized pregnancies end in miscarriage. However, many miscarriages often occur before a woman even knows she is pregnant.

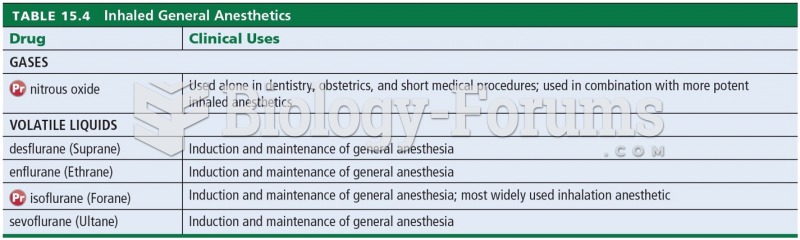

Anesthesia awareness is a potentially disturbing adverse effect wherein patients who have been paralyzed with muscle relaxants may awaken. They may be aware of their surroundings but unable to communicate or move. Neurologic monitoring equipment that helps to more closely check the patient's anesthesia stages is now available to avoid the occurrence of anesthesia awareness.

The most dangerous mercury compound, dimethyl mercury, is so toxic that even a few microliters spilled on the skin can cause death. Mercury has been shown to accumulate in higher amounts in the following types of fish than other types: swordfish, shark, mackerel, tilefish, crab, and tuna.