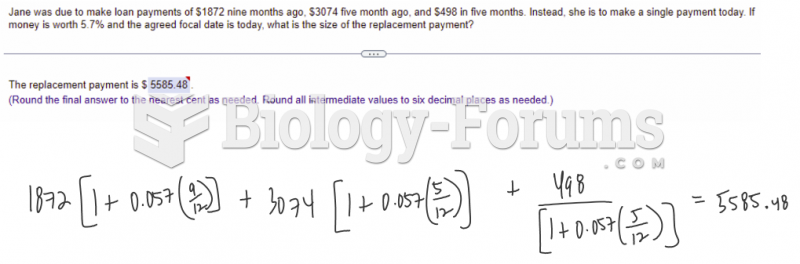

This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

This year, an estimated 1.4 million Americans will have a new or recurrent heart attack.

Did you know?

Stroke kills people from all ethnic backgrounds, but the people at highest risk for fatal strokes are: black men, black women, Asian men, white men, and white women.

Did you know?

More than 150,000 Americans killed by cardiovascular disease are younger than the age of 65 years.

Did you know?

Nearly 31 million adults in America have a total cholesterol level that is more than 240 mg per dL.

Did you know?

The first documented use of surgical anesthesia in the United States was in Connecticut in 1844.