|

|

|

Did you know?

Famous people who died from poisoning or drug overdose include, Adolf Hitler, Socrates, Juan Ponce de Leon, Marilyn Monroe, Judy Garland, and John Belushi.

Did you know?

The calories found in one piece of cherry cheesecake could light a 60-watt light bulb for 1.5 hours.

Did you know?

During pregnancy, a woman is more likely to experience bleeding gums and nosebleeds caused by hormonal changes that increase blood flow to the mouth and nose.

Did you know?

Human stomach acid is strong enough to dissolve small pieces of metal such as razor blades or staples.

Did you know?

Vampire bats have a natural anticoagulant in their saliva that permits continuous bleeding after they painlessly open a wound with their incisors. This capillary blood does not cause any significant blood loss to their victims.

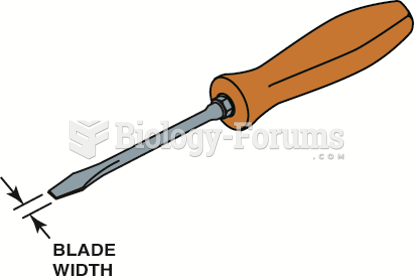

A flat-tip (straight-blade) screwdriver. The width of the blade should match the width of the slot ...

A flat-tip (straight-blade) screwdriver. The width of the blade should match the width of the slot ...

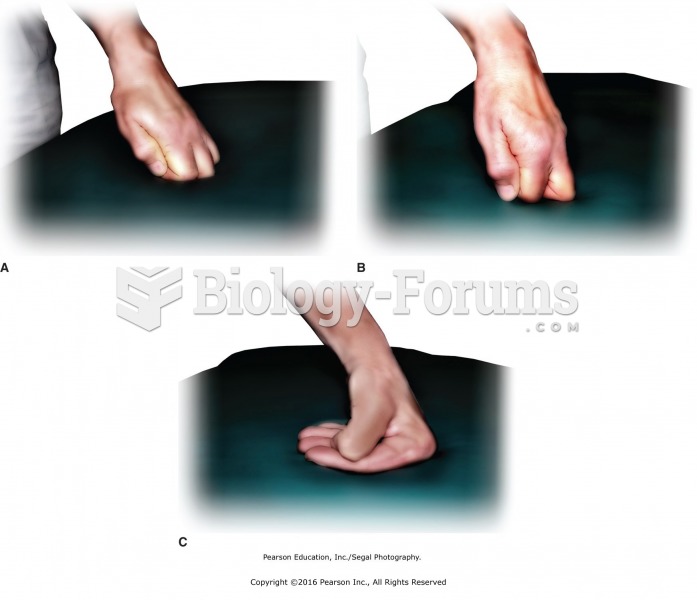

Different hand positions and working surfaces for massage applications on large muscles. A. Flat ...

Different hand positions and working surfaces for massage applications on large muscles. A. Flat ...