|

|

|

In 1835 it was discovered that a disease of silkworms known as muscardine could be transferred from one silkworm to another, and was caused by a fungus.

Egg cells are about the size of a grain of sand. They are formed inside of a female's ovaries before she is even born.

Medication errors are three times higher among children and infants than with adults.

More than 20 million Americans cite use of marijuana within the past 30 days, according to the National Survey on Drug Use and Health (NSDUH). More than 8 million admit to using it almost every day.

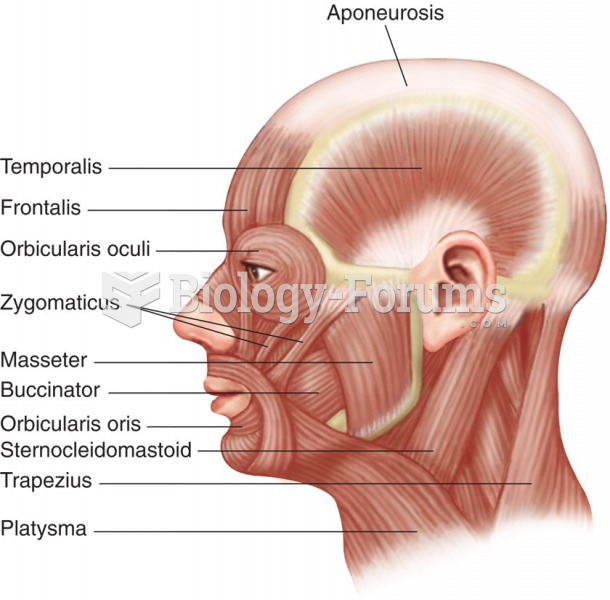

Although not all of the following muscle groups are commonly used, intramuscular injections may be given into the abdominals, biceps, calves, deltoids, gluteals, laterals, pectorals, quadriceps, trapezoids, and triceps.

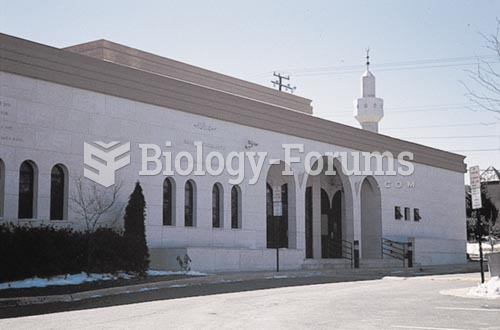

All Muslims must face Mecca, Saudi Arabia, to pray. Here, the minaret of a mosque is aligned with Me

All Muslims must face Mecca, Saudi Arabia, to pray. Here, the minaret of a mosque is aligned with Me

Cushing syndrome. This syndrome includes the symptoms of obesity, moon face, hyperglycemia, and musc

Cushing syndrome. This syndrome includes the symptoms of obesity, moon face, hyperglycemia, and musc