This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Since 1988, the CDC has reported a 99% reduction in bacterial meningitis caused by Haemophilus influenzae, due to the introduction of the vaccine against it.

Did you know?

Human stomach acid is strong enough to dissolve small pieces of metal such as razor blades or staples.

Did you know?

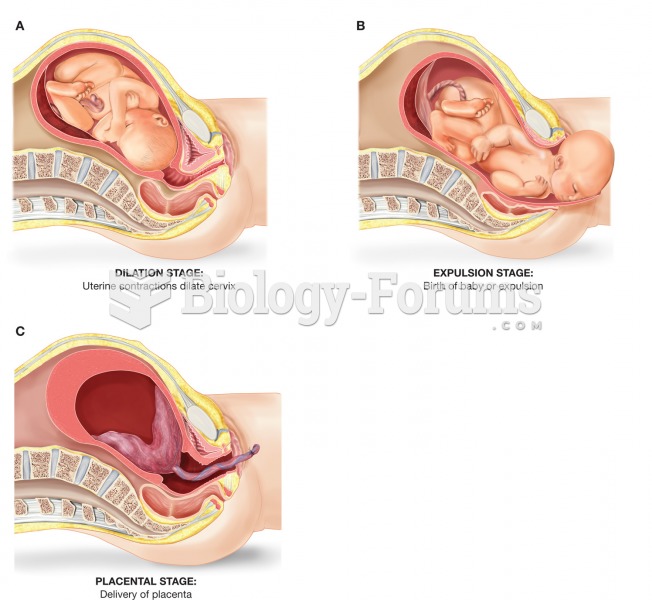

Approximately one in three babies in the United States is now delivered by cesarean section. The number of cesarean sections in the United States has risen 46% since 1996.

Did you know?

Inotropic therapy does not have a role in the treatment of most heart failure patients. These drugs can make patients feel and function better but usually do not lengthen the predicted length of their lives.

Did you know?

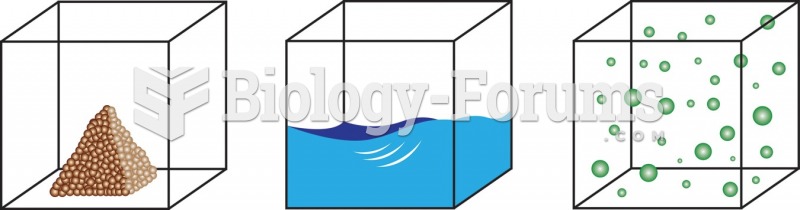

The ratio of hydrogen atoms to oxygen in water (H2O) is 2:1.