|

|

|

The U.S. Pharmacopeia Medication Errors Reporting Program states that approximately 50% of all medication errors involve insulin.

Children with strabismus (crossed eyes) can be treated. They are not able to outgrow this condition on their own, but with help, it can be more easily corrected at a younger age. It is important for infants to have eye examinations as early as possible in their development and then another at age 2 years.

In 1885, the Lloyd Manufacturing Company of Albany, New York, promoted and sold "Cocaine Toothache Drops" at 15 cents per bottle! In 1914, the Harrison Narcotic Act brought the sale and distribution of this drug under federal control.

Human kidneys will clean about 1 million gallons of blood in an average lifetime.

Inotropic therapy does not have a role in the treatment of most heart failure patients. These drugs can make patients feel and function better but usually do not lengthen the predicted length of their lives.

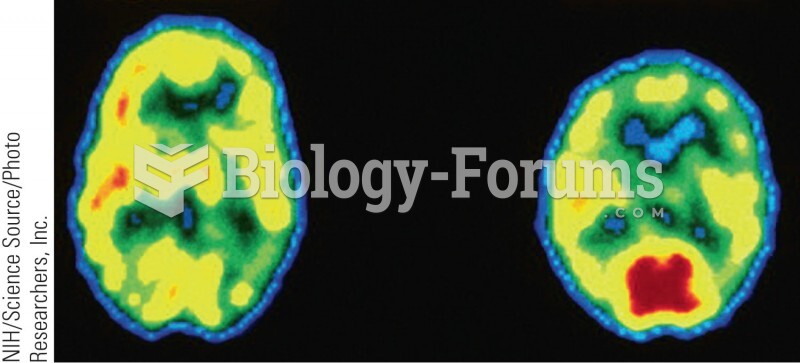

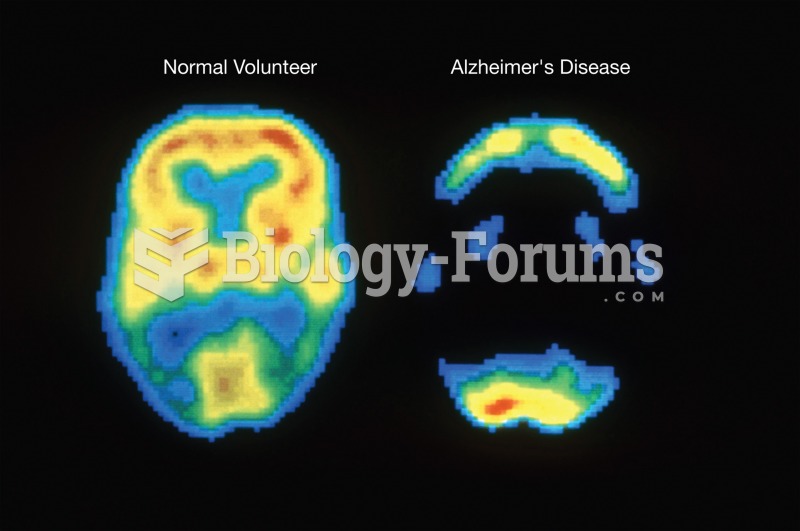

Positron emission tomography (PET) image showing the difference in the metabolic activity of the bra

Positron emission tomography (PET) image showing the difference in the metabolic activity of the bra

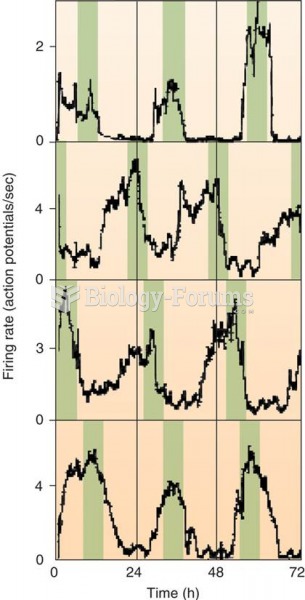

Firing Rate of Individual SCN Neurons in a Tissue Culture Color bars have been added to emphasize th

Firing Rate of Individual SCN Neurons in a Tissue Culture Color bars have been added to emphasize th