|

|

|

Prostaglandins were first isolated from human semen in Sweden in the 1930s. They were so named because the researcher thought that they came from the prostate gland. In fact, prostaglandins exist and are synthesized in almost every cell of the body.

Recent studies have shown that the number of medication errors increases in relation to the number of orders that are verified per pharmacist, per work shift.

Parkinson's disease is both chronic and progressive. This means that it persists over a long period of time and that its symptoms grow worse over time.

The first war in which wide-scale use of anesthetics occurred was the Civil War, and 80% of all wounds were in the extremities.

Pink eye is a term that refers to conjunctivitis, which is inflammation of the thin, clear membrane (conjunctiva) over the white part of the eye (sclera). It may be triggered by a virus, bacteria, or foreign body in the eye. Antibiotic eye drops alleviate bacterial conjunctivitis, and antihistamine allergy pills or eye drops help control allergic conjunctivitis symptoms.

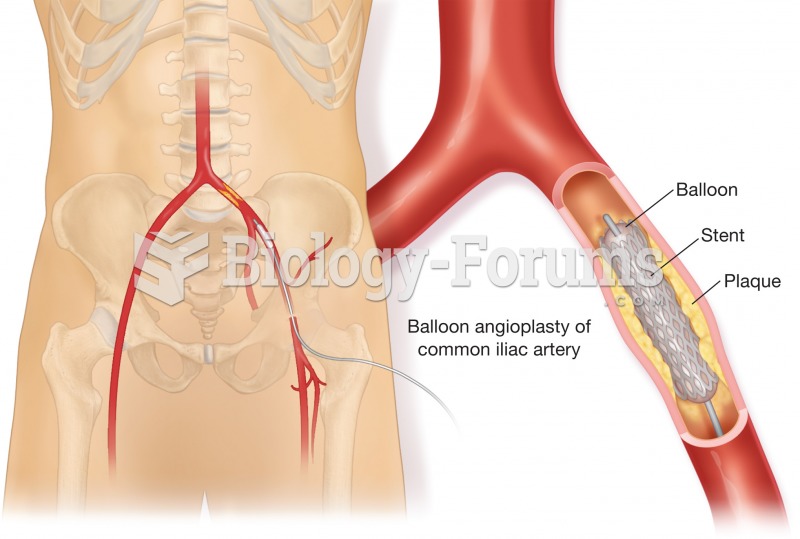

Angioplasty. One form is called balloon angioplasty, shown here. A balloon catheter is threaded into

Angioplasty. One form is called balloon angioplasty, shown here. A balloon catheter is threaded into

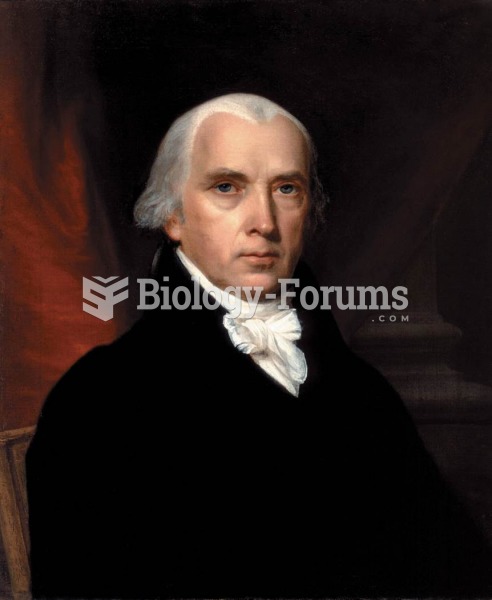

James Madison was a key figure at the Constitutional Convention of 1787 in Philadelphia. He not only

James Madison was a key figure at the Constitutional Convention of 1787 in Philadelphia. He not only

The Kingsley plantation, on Fort George Island in Jacksonville, Florida. Zephaniah Kingsley, the own

The Kingsley plantation, on Fort George Island in Jacksonville, Florida. Zephaniah Kingsley, the own

Mobilize knuckles with figure-8s. Turn the hand so palm faces the table. Grasp the proximal phalange ...

Mobilize knuckles with figure-8s. Turn the hand so palm faces the table. Grasp the proximal phalange ...