|

|

|

Automated pill dispensing systems have alarms to alert patients when the correct dosing time has arrived. Most systems work with many varieties of medications, so patients who are taking a variety of drugs can still be in control of their dose regimen.

The highest suicide rate in the United States is among people ages 65 years and older. Almost 15% of people in this age group commit suicide every year.

Never take aspirin without food because it is likely to irritate your stomach. Never give aspirin to children under age 12. Overdoses of aspirin have the potential to cause deafness.

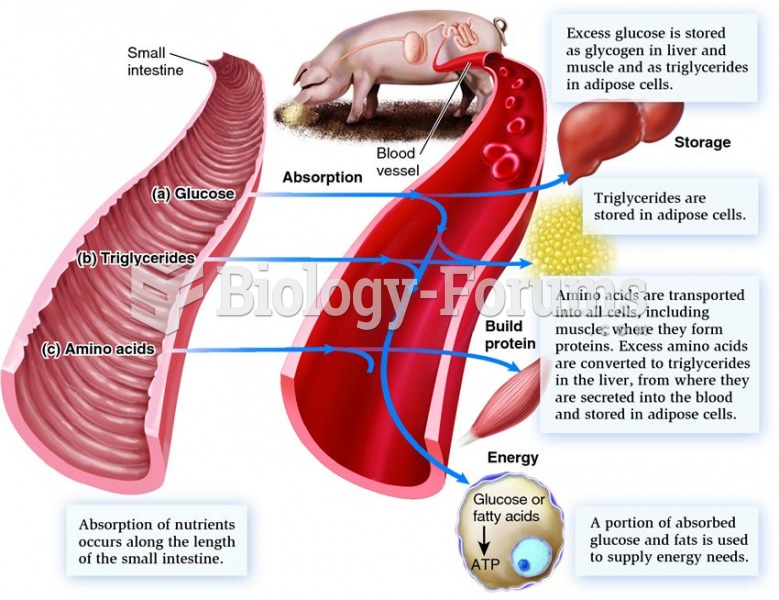

According to animal studies, the typical American diet is damaging to the liver and may result in allergies, low energy, digestive problems, and a lack of ability to detoxify harmful substances.

When blood is exposed to air, it clots. Heparin allows the blood to come in direct contact with air without clotting.