|

|

|

Many medications that are used to treat infertility are injected subcutaneously. This is easy to do using the anterior abdomen as the site of injection but avoiding the area directly around the belly button.

Coca-Cola originally used coca leaves and caffeine from the African kola nut. It was advertised as a therapeutic agent and "pickerupper." Eventually, its formulation was changed, and the coca leaves were removed because of the effects of regulation on cocaine-related products.

Nitroglycerin is used to alleviate various heart-related conditions, and it is also the chief component of dynamite (but mixed in a solid clay base to stabilize it).

Calcitonin is a naturally occurring hormone. In women who are at least 5 years beyond menopause, it slows bone loss and increases spinal bone density.

Persons who overdose with cardiac glycosides have a better chance of overall survival if they can survive the first 24 hours after the overdose.

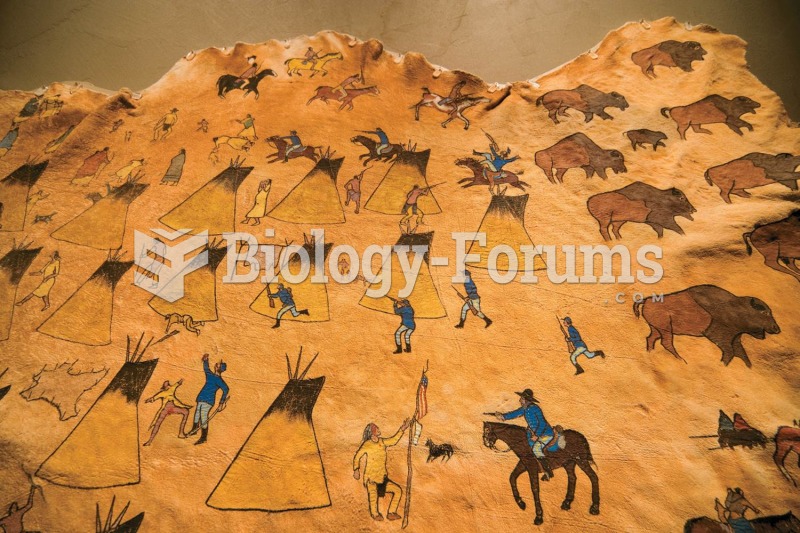

This Native American depiction of the Sand Creek Massacre, painted on a buffalo hide, shows the Indi

This Native American depiction of the Sand Creek Massacre, painted on a buffalo hide, shows the Indi

A family of African Americans arrive in Chicago, migrants from the American South, in an exodus that

A family of African Americans arrive in Chicago, migrants from the American South, in an exodus that