|

|

|

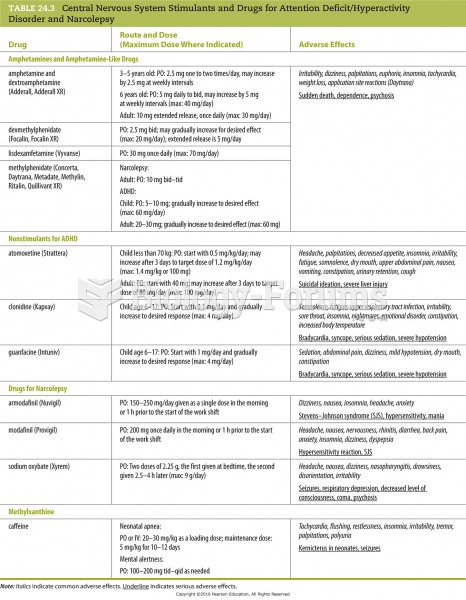

Lower drug doses for elderly patients should be used first, with titrations of the dose as tolerated to prevent unwanted drug-related pharmacodynamic effects.

The U.S. Preventive Services Task Force recommends that all women age 65 years of age or older should be screened with bone densitometry.

In 1885, the Lloyd Manufacturing Company of Albany, New York, promoted and sold "Cocaine Toothache Drops" at 15 cents per bottle! In 1914, the Harrison Narcotic Act brought the sale and distribution of this drug under federal control.

If you could remove all of your skin, it would weigh up to 5 pounds.

The shortest mature adult human of whom there is independent evidence was Gul Mohammed in India. In 1990, he was measured in New Delhi and stood 22.5 inches tall.