|

|

|

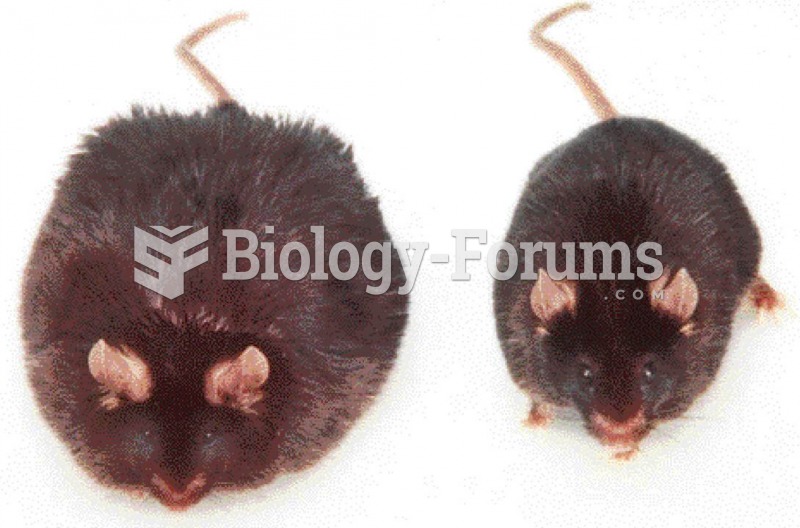

More than one-third of adult Americans are obese. Diseases that kill the largest number of people annually, such as heart disease, cancer, diabetes, stroke, and hypertension, can be attributed to diet.

If you use artificial sweeteners, such as cyclamates, your eyes may be more sensitive to light. Other factors that will make your eyes more sensitive to light include use of antibiotics, oral contraceptives, hypertension medications, diuretics, and antidiabetic medications.

Green tea is able to stop the scent of garlic or onion from causing bad breath.

Patients who have been on total parenteral nutrition for more than a few days may need to have foods gradually reintroduced to give the digestive tract time to start working again.

Walt Disney helped combat malaria by making an animated film in 1943 called The Winged Scourge. This short film starred the seven dwarfs and taught children that mosquitos transmit malaria, which is a very bad disease. It advocated the killing of mosquitos to stop the disease.