|

|

|

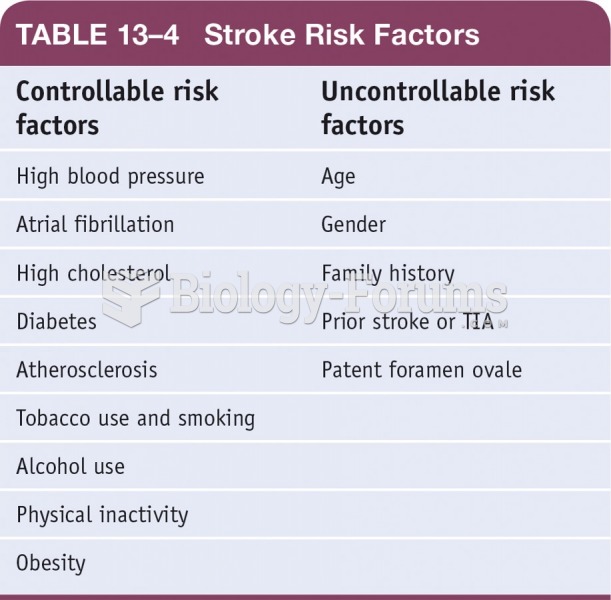

Less than one of every three adults with high LDL cholesterol has the condition under control. Only 48.1% with the condition are being treated for it.

The term bacteria was devised in the 19th century by German biologist Ferdinand Cohn. He based it on the Greek word "bakterion" meaning a small rod or staff. Cohn is considered to be the father of modern bacteriology.

Essential fatty acids have been shown to be effective against ulcers, asthma, dental cavities, and skin disorders such as acne.

Asthma cases in Americans are about 75% higher today than they were in 1980.

Adult head lice are gray, about ? inch long, and often have a tiny dot on their backs. A female can lay between 50 and 150 eggs within the several weeks that she is alive. They feed on human blood.