|

|

|

In 1886, William Bates reported on the discovery of a substance produced by the adrenal gland that turned out to be epinephrine (adrenaline). In 1904, this drug was first artificially synthesized by Friedrich Stolz.

Chronic necrotizing aspergillosis has a slowly progressive process that, unlike invasive aspergillosis, does not spread to other organ systems or the blood vessels. It most often affects middle-aged and elderly individuals, spreading to surrounding tissue in the lungs. The disease often does not respond to conventionally successful treatments, and requires individualized therapies in order to keep it from becoming life-threatening.

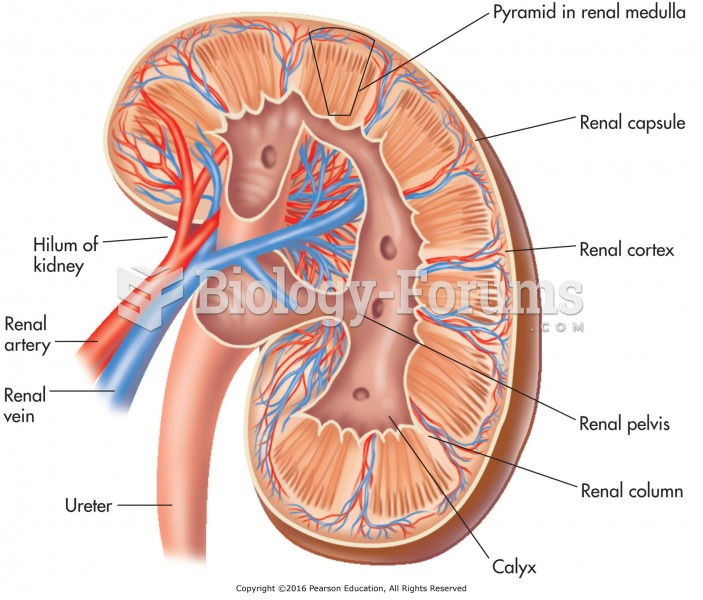

In most cases, kidneys can recover from almost complete loss of function, such as in acute kidney (renal) failure.

About 3% of all pregnant women will give birth to twins, which is an increase in rate of nearly 60% since the early 1980s.

The highest suicide rate in the United States is among people ages 65 years and older. Almost 15% of people in this age group commit suicide every year.