|

|

|

Nearly all drugs pass into human breast milk. How often a drug is taken influences the amount of drug that will pass into the milk. Medications taken 30 to 60 minutes before breastfeeding are likely to be at peak blood levels when the baby is nursing.

Blood is approximately twice as thick as water because of the cells and other components found in it.

Asthma-like symptoms were first recorded about 3,500 years ago in Egypt. The first manuscript specifically written about asthma was in the year 1190, describing a condition characterized by sudden breathlessness. The treatments listed in this manuscript include chicken soup, herbs, and sexual abstinence.

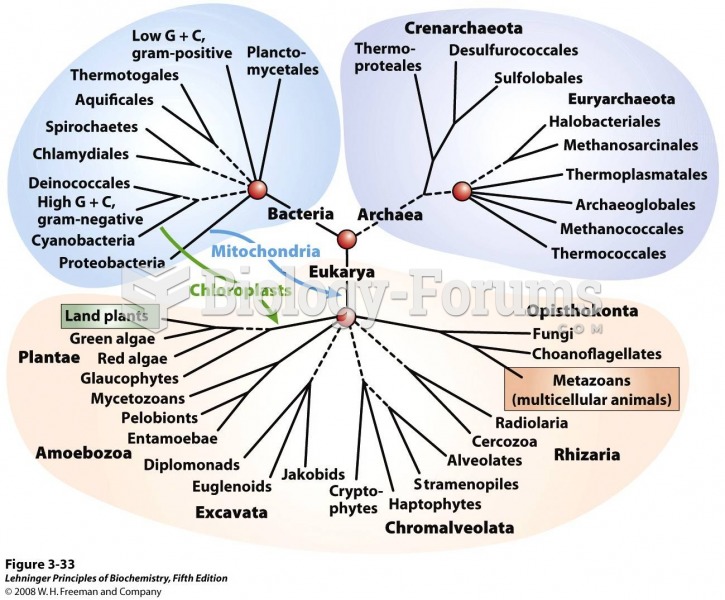

Bacteria have flourished on the earth for over three billion years. They were the first life forms on the planet.

It is believed that the Incas used anesthesia. Evidence supports the theory that shamans chewed cocoa leaves and drilled holes into the heads of patients (letting evil spirits escape), spitting into the wounds they made. The mixture of cocaine, saliva, and resin numbed the site enough to allow hours of drilling.