|

|

|

Did you know?

Critical care patients are twice as likely to receive the wrong medication. Of these errors, 20% are life-threatening, and 42% require additional life-sustaining treatments.

Did you know?

Urine turns bright yellow if larger than normal amounts of certain substances are consumed; one of these substances is asparagus.

Did you know?

The highest suicide rate in the United States is among people ages 65 years and older. Almost 15% of people in this age group commit suicide every year.

Did you know?

The most destructive flu epidemic of all times in recorded history occurred in 1918, with approximately 20 million deaths worldwide.

Did you know?

Asthma occurs in one in 11 children and in one in 12 adults. African Americans and Latinos have a higher risk for developing asthma than other groups.

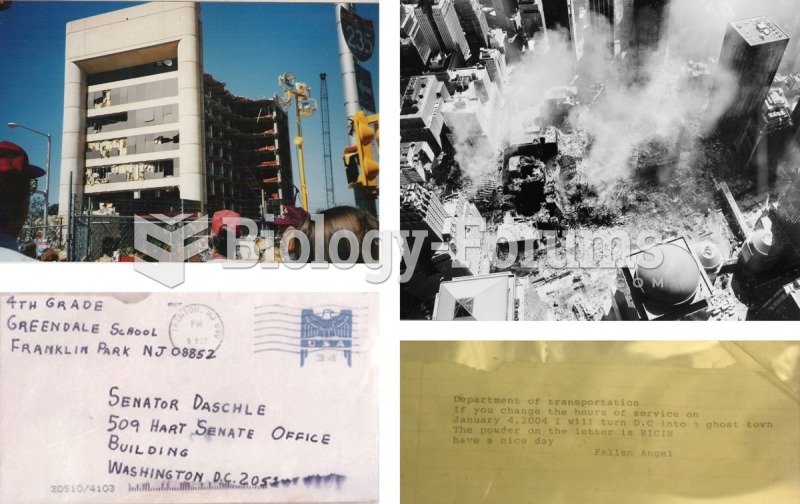

In 2013, Americans learned that the federal government massively surveys their phone calls and e-mai

In 2013, Americans learned that the federal government massively surveys their phone calls and e-mai

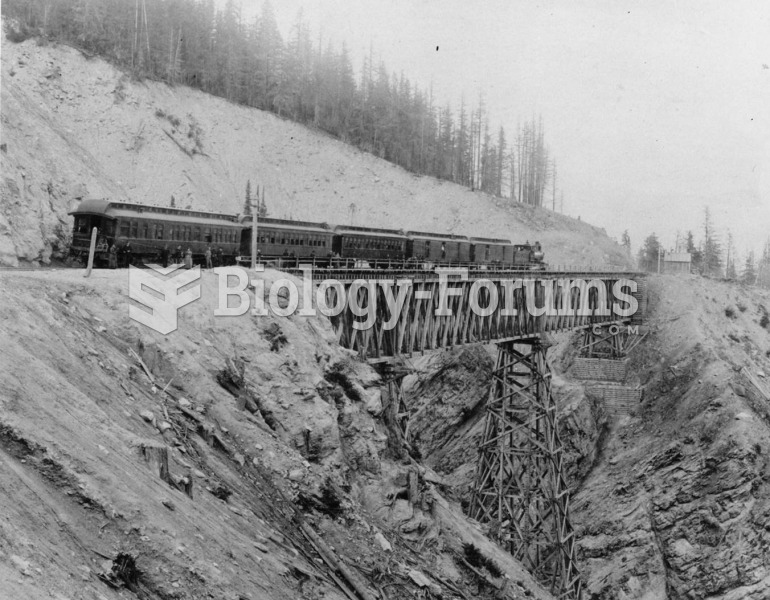

A passenger train crosses Stony Creek Bridge in the Rocky Mountains in 1878. Railroads were importan

A passenger train crosses Stony Creek Bridge in the Rocky Mountains in 1878. Railroads were importan