|

|

|

Coca-Cola originally used coca leaves and caffeine from the African kola nut. It was advertised as a therapeutic agent and "pickerupper." Eventually, its formulation was changed, and the coca leaves were removed because of the effects of regulation on cocaine-related products.

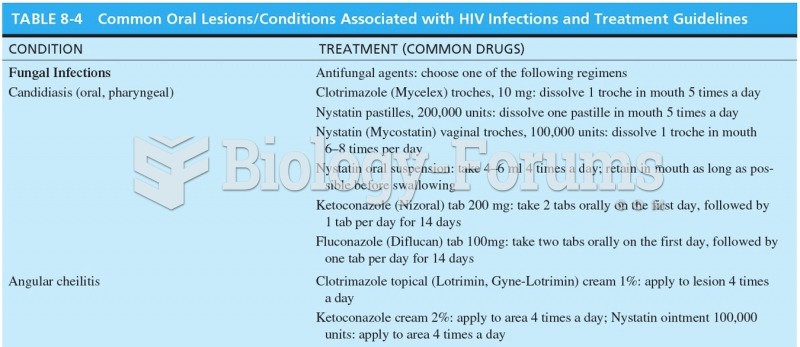

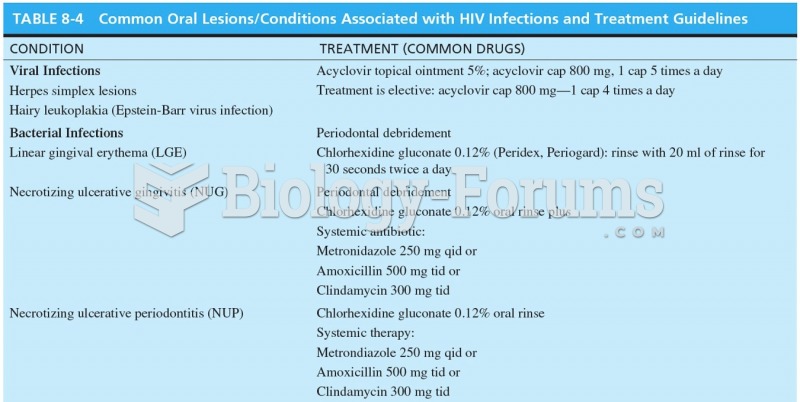

As of mid-2016, 18.2 million people were receiving advanced retroviral therapy (ART) worldwide. This represents between 43–50% of the 34–39.8 million people living with HIV.

All adults should have their cholesterol levels checked once every 5 years. During 2009–2010, 69.4% of Americans age 20 and older reported having their cholesterol checked within the last five years.

By definition, when a medication is administered intravenously, its bioavailability is 100%.

About 3% of all pregnant women will give birth to twins, which is an increase in rate of nearly 60% since the early 1980s.