|

|

|

Cucumber slices relieve headaches by tightening blood vessels, reducing blood flow to the area, and relieving pressure.

Human neurons are so small that they require a microscope in order to be seen. However, some neurons can be up to 3 feet long, such as those that extend from the spinal cord to the toes.

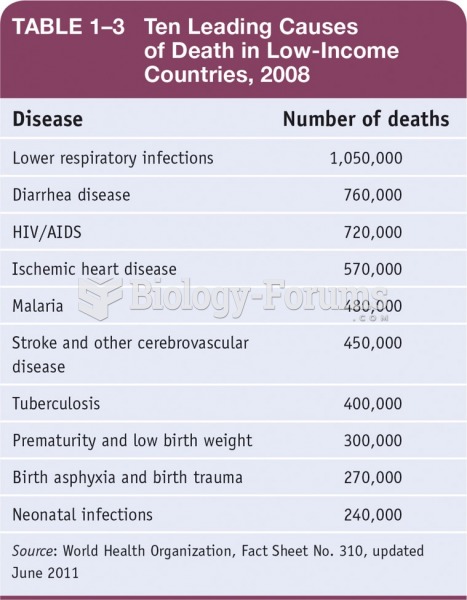

More than one-third of adult Americans are obese. Diseases that kill the largest number of people annually, such as heart disease, cancer, diabetes, stroke, and hypertension, can be attributed to diet.

Sperm cells are so tiny that 400 to 500 million (400,000,000–500,000,000) of them fit onto 1 tsp.

When Gabriel Fahrenheit invented the first mercury thermometer, he called "zero degrees" the lowest temperature he was able to attain with a mixture of ice and salt. For the upper point of his scale, he used 96°, which he measured as normal human body temperature (we know it to be 98.6° today because of more accurate thermometers).