|

|

|

The average office desk has 400 times more bacteria on it than a toilet.

Between 1999 and 2012, American adults with high total cholesterol decreased from 18.3% to 12.9%

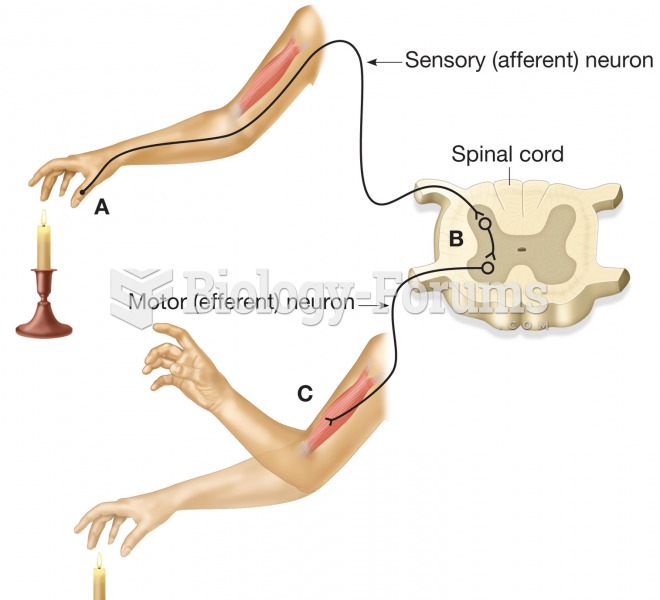

Multiple sclerosis is a condition wherein the body's nervous system is weakened by an autoimmune reaction that attacks the myelin sheaths of neurons.

There are major differences in the metabolism of morphine and the illegal drug heroin. Morphine mostly produces its CNS effects through m-receptors, and at k- and d-receptors. Heroin has a slight affinity for opiate receptors. Most of its actions are due to metabolism to active metabolites (6-acetylmorphine, morphine, and morphine-6-glucuronide).

The calories found in one piece of cherry cheesecake could light a 60-watt light bulb for 1.5 hours.