|

|

|

In most climates, 8 to 10 glasses of water per day is recommended for adults. The best indicator for adequate fluid intake is frequent, clear urination.

People often find it difficult to accept the idea that bacteria can be beneficial and improve health. Lactic acid bacteria are good, and when eaten, these bacteria improve health and increase longevity. These bacteria included in foods such as yogurt.

Anti-aging claims should not ever be believed. There is no supplement, medication, or any other substance that has been proven to slow or stop the aging process.

The human body's pharmacokinetics are quite varied. Our hair holds onto drugs longer than our urine, blood, or saliva. For example, alcohol can be detected in the hair for up to 90 days after it was consumed. The same is true for marijuana, cocaine, ecstasy, heroin, methamphetamine, and nicotine.

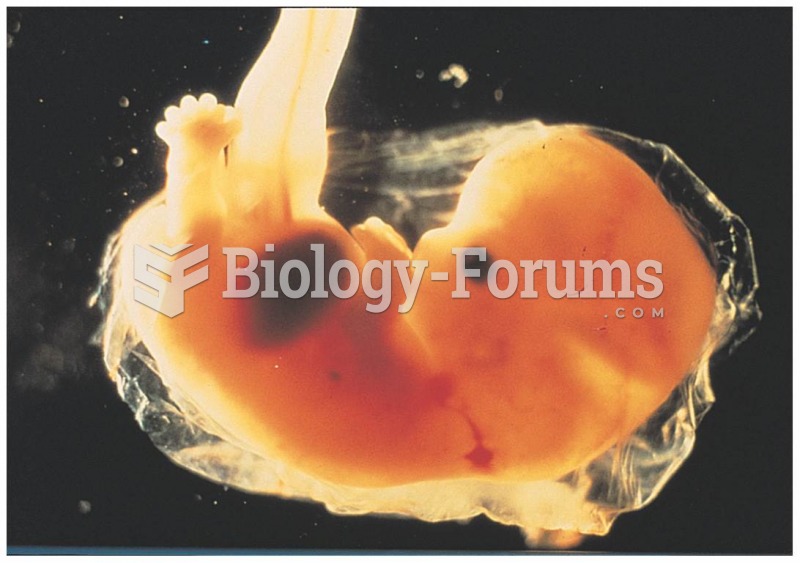

Approximately 15–25% of recognized pregnancies end in miscarriage. However, many miscarriages often occur before a woman even knows she is pregnant.