Answer to Question 1

C

Answer to Question 2

1.

Beginning Inventory + 2014 Production = 2014 Sales + Ending Inventory

85,000 units + 2014 Production = 345,400 units + 34,500 units

2014 Production = 294,900 units

Income Statement for the Zwatch Company, Variable Costing

for the Year Ended December 31, 2014

Revenues: 22 345,400 7,598,800

Variable costs

Beginning inventory: 5.10 85,000 433,500

Variable manufacturing costs: 5.10 294,900 1,503,990

Cost of goods available for sale 1,937,490

Deduct ending inventory: 5.10 34,500 (175,950)

Variable cost of goods sold 1,761,540

Variable operating costs: 1.10 345,400 379,940

Adjustment for variances 0

Total variable costs 2,141,480

Contribution margin 5,457,320

Fixed costs

Fixed manufacturing overhead costs 1,440,000

Fixed operating costs 1,080,000

Total fixed costs 2,520,000

Operating income 2,937,320

Absorption Costing Data

Fixed manufacturing overhead allocation rate =

Fixed manufacturing overhead/Denominator level machine-hours = 1,440,000 6,000

= 240 per machine-hour

Fixed manufacturing overhead allocation rate per unit =

Fixed manufacturing overhead allocation rate/standard production rate = 240 50

= 4.80 per unit

Income Statement for the Zwatch Company, Absorption Costing

for the Year Ended December 31, 2014

Revenues: 22 345,400 7,598,800

Cost of goods sold

Beginning inventory (5.10 + 4.80) 85,000 841,500

Variable manuf. costs: 5.10 294,900 1,503,990

Allocated fixed manuf. costs: 4.80 294,900 1,415,520

Cost of goods available for sale 3,761,010

Deduct ending inventory: (5.10 + 4.80) 34,500 (341,550)

Adjust for manuf. variances (4.80 5,100)a 24,480 U

Cost of goods sold 3,443,940

Gross margin 4,154,860

Operating costs

Variable operating costs: 1.10 345,400 379,940

Fixed operating costs 1,080,000

Total operating costs 1,459,940

Operating income 2,694,920

a Production volume variance = (6,000 hours 50) 294,900 4.80

= (300,000 294,900) 4.80

= 24,480

2. Zwatch's operating margins as a percentage of revenues are

Under variable costing:

Revenues 7,598,800

Operating income 2,937,320

Operating income as percentage of revenues 38.7

Under absorption costing:

Revenues 7,598,800

Operating income 2,694,920

Operating income as percentage of revenues 35.5

3. Operating income using variable costing is about 9 percent higher than operating income calculated using absorption costing.

Variable costing operating income Absorption costing operating income =

2,937,320 2,694,920 = 242,400

Fixed manufacturing costs in beginning inventory under absorption costing

Fixed manufacturing costs in ending inventory under absorption costing

= (4.80 85,000) (4.80 34,500) = 242,400

4. The factors the CFO should consider include

(a) Effect on managerial behavior.

(b) Effect on external users of financial statements.

I would recommend absorption costing because it considers all the manufacturing resources (whether variable or fixed) used to produce units of output. Absorption costing has many critics. However, the dysfunctional aspects associated with absorption costing can be reduced by

Careful budgeting and inventory planning.

Adding a capital charge to reduce the incentives to build up inventory.

Monitoring nonfinancial performance measures.

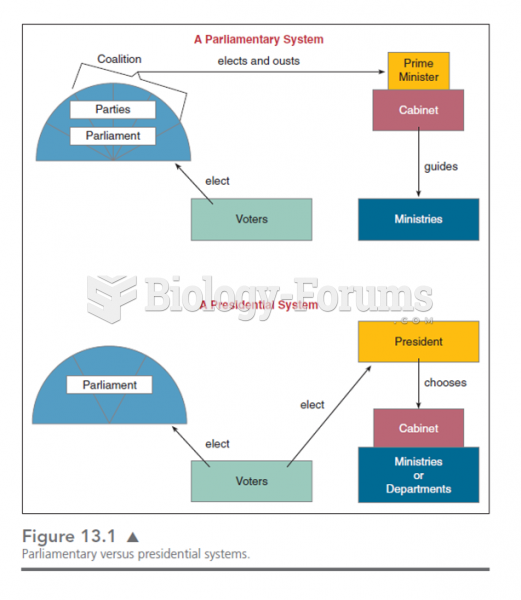

This chart shows the various lines of responsibility and how they differ in presidential and parliam

This chart shows the various lines of responsibility and how they differ in presidential and parliam

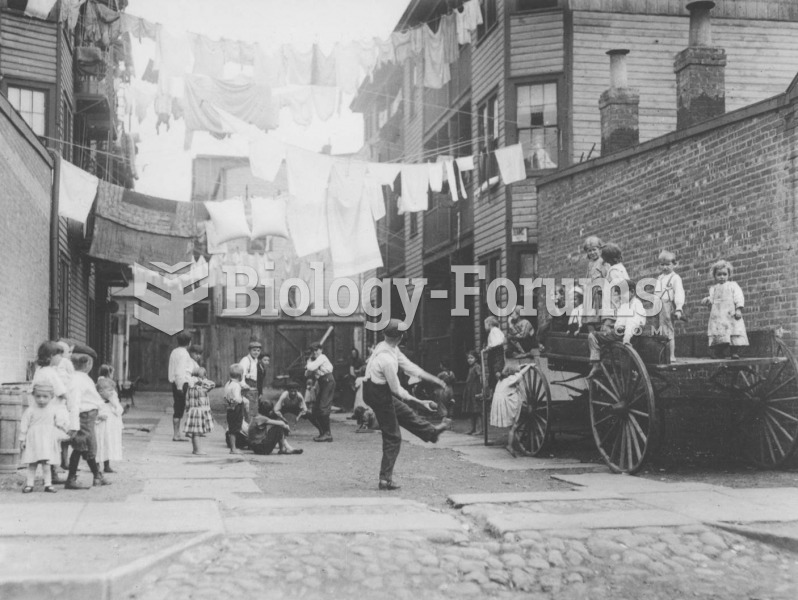

Lewis Hine’s 1910 photograph shows a tenement alley in New York City. More famous for his “unsettlin

Lewis Hine’s 1910 photograph shows a tenement alley in New York City. More famous for his “unsettlin