Answer to Question 1

B

Answer to Question 2

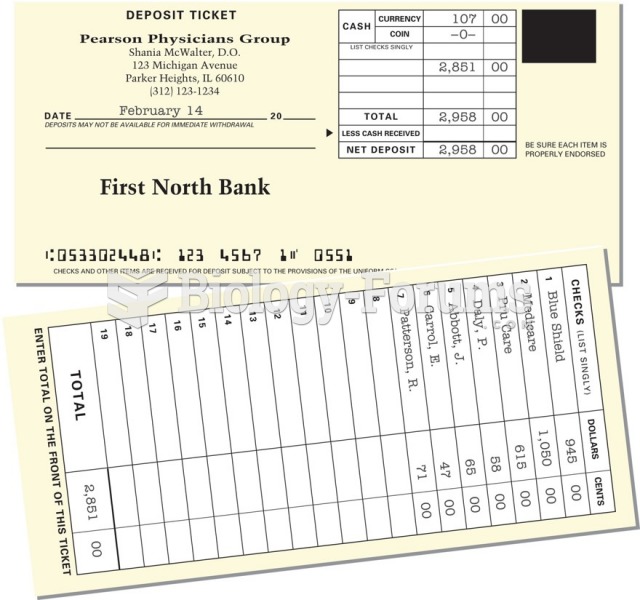

1. Solution Exhibit 8- 23 shows the computations. Summary details are:

Actual Flexible Budget

Output units 65,500 65,500

Allocation base (machine-hours) 76,400 78,600a

Allocation base per output unit 1.17b 1.2

Variable MOH 618,840 628,800c

Variable MOH per hour 8.92d 8.00

Fixed MOH 145,790 144,000

Fixed MOH per hour 1.91e

a 65,500 1.2 = 78,600 d 618,840 76,400 = 8.10

b 76,400 65,500 = 1.17 e 145,790 76,400 = 1.91

c 65,500 1.2 8 = 628,800

An overview of the 4-variance analysis is:

4-Variance

Analysis Spending

Variance Efficiency

Variance Production-Volume Variance

Variable

Manufacturing

Overhead

7,640 U

17,600 F

Never a variance

Fixed

Manufacturing

Overhead

1,790 U

Never a variance

13,200 F

2. Variable Manufacturing Overhead Control 618,840

Accounts Payable Control and other accounts 618,840

Work-in-Process Control 628,800

Variable Manufacturing Overhead Allocated 628,800

Variable Manufacturing Overhead Allocated 628,800

Variable Manufacturing Overhead Spending Variance 7,640

Variable Manufacturing Overhead Efficiency Variance 17,600

Variable Manufacturing Overhead Control 618,840

Fixed Manufacturing Overhead Control 145,790

Wages Payable Control, Accumulated

Depreciation Control, etc. 145,790

Work-in-Process Control 157,200

Fixed Manufacturing Overhead Allocated 157,200

Fixed Manufacturing Overhead Allocated 157,200

Fixed Manufacturing Overhead Spending Variance 1,790

Fixed Manufacturing Overhead Production-Volume Variance 13,200

Fixed Manufacturing Overhead Control 145,790

3. The control of variable manufacturing overhead requires the identification of the cost drivers for such items as energy, supplies, and repairs. Control often entails monitoring nonfinancial measures that affect each cost item, one by one. Examples are kilowatt-hours used, quantities of lubricants used, and repair parts and hours used. The most convincing way to discover why overhead performance did not agree with a budget is to investigate possible causes, line item by line item.

4. The variable overhead spending variance is unfavorable. This means the actual rate applied to the manufacturing costs is higher than the budgeted rate. Because variable overhead consists of several different costs, this could be for a variety of reasons, such as the utility rates being higher than estimated or the indirect materials costs per unit of denominator activity being more than estimated.

The variable overhead efficiency variance is favorable, which implies that the estimated denominator activity was too high. Because the denominator activity is machine hours, this could be the result of efficient use of machines, better scheduling of production runs, or machines that are well maintained and thus are working at more than the expected level of efficiency.

EXHIBIT 8- 23

Actual Costs

Incurred

(1)

Actual Input

Budgeted Rate

(2) Flexible Budget:

Budgeted Input

Allowed for

Actual Output

Budgeted Rate

(3) Allocated:

Budgeted Input

Allowed for

Actual Output

Budgeted Rate

(4)

Variable

Manufacturing

Overhead

618,840 (76,400 8)

611,200 (78,600 8)

628,800 (78,600 8)

628,800

Actual Costs Incurred

(1)

Same Budgeted

Lump Sum

(as in Static Budget)

Regardless of

Output Level

(2) Flexible Budget:

Same Budgeted

Lump Sum

(as in Static Budget)

Regardless of

Output Level

(3)

Allocated:

Budgeted Input

Allowed for

Actual Output

Budgeted Rate

(4)

Fixed

Manufacturing

Overhead

145,790

144,000

144,000 (78,600 2)

157,200

Fixed manufacturing overheadbudgeted rate =144,000 / 72,000 machine-hours = 2 per machine-hour.