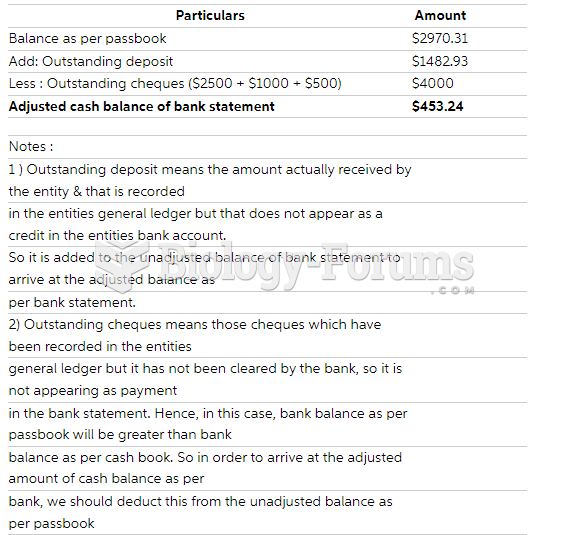

Answer to Question 1

C

Answer to Question 2

1. Simple costing system:

Total indirect costs = 190,000 + 90,000 + 50,000 + 120,000 + 16,000 + 3(250 3,200) + (400 1,800)

= 511,600

Total machine-hours = 5,500 + 4,500 = 10,000

Indirect cost rate per machine-hour = 511,600 10,000

= 51.16 per machine-hour

Simple Costing System Interior Exterior

Direct materialsa 192,000 162,000

Direct manufacturing laborb 153,600 129,600

Indirect cost allocated to each job

(51.16 5,500; 4,500 machine hours) 281,380 230,220

Total costs 626,980 521,820

Total cost per unit

(626,980 3,200; 521,820 1,800) 195.93 289.90

a 60 3,200 units; 90 1,800 units

b 32 1.5 3,200 units; 32 2.25 1,800 units

2. Activity-based costing system

Activity

(1) Total Cost of Activity

(2) Cost Driver

(3) Cost Driver Quantity

(4) Allocation Rate

(5) = (2) (4)

Product scheduling 190,000 production runs 125c 1,520.00 per production run

Material handling 90,000 material moves 240d 375.00 per material move

Machine setup 50,000 machine setups 200e 250.00 per setup

Assembly 120,000 machine hours 10,000 12.00 per machine hour

Inspection 16,000 inspections 400f 40.00 per inspection

Marketing Percentage of revenues 0.03 per dollar of sales

c 40 + 85 = 125; d 72 + 168 = 240; e 45 + 155 = 200; f 250 + 150 = 400

ABC System Interior Exterior

Direct materials 192,000 162,000

Direct manufacturing labor 153,600 129,600

Indirect costs allocated:

Product scheduling (1,520 per run 40; 85)

60,800 129,200

Material handling (375.00 per move 72; 168)

27,000 63,000

Machine setup (250 per setup 45; 155)

11,250 38,750

Assembly (12 per MH 5,500; 4,500) 66,000 54,000

Inspection (40 per inspection 250; 150) 10,000 6,000

Marketing (0.03 250 3,200; 0.03 400 1,800)

24,000 21,600

Total costs 544,650 604,150

Total cost per unit

(544,650 3,200 units; 604,150 1,800 units) 170.20 335.64

3.

Cost per unit Interior Exterior

Simple Costing System 195.93 289.90

Activity-based Costing System 170.20 335.64

Difference (Simple ABC) 25.73 (45.74)

Relative to the ABC system, the simple costing system overcosts interior doors and undercosts exterior doors. Interior doors require 1.72 machine-hours per unit while exterior doors require 2.5 machine-hours per unit. In the simple-costing system, overhead costs are allocated to the interior and exterior doors on the basis of the machine-hours used by each type of door. The ABC study reveals that the ratio of the cost of production runs, material moves, and setups for each exterior door versus each interior door is even higher than the ratio of 2.5 to 1.72 machine-hours for each exterior relative to each interior door. This higher ratio results in higher indirect costs allocated to exterior doors relative to interior doors in the ABC system.

4. Fancy Doors, Inc. can use the information revealed by the ABC system to change its pricing based on the ABC costs. Under the simple system, Fancy Doors was making an operating margin of 21.6 on each interior door (250 195.93 250) and 27.5 on each exterior door (400 289.90 400). But, the ABC system reveals that it is actually making an operating margin of about 32 (250 170.20 250) on each interior door and about 16 (400 335.64 400) on each exterior door. Fancy Doors, Inc., should consider decreasing the price of its interior doors to be more competitive. Fancy Doors should also consider increasing the price of its exterior doors, depending on the competition it faces in this market.

Fancy Doors can also use the ABC information to improve its own operations. It could examine each of the indirect cost categories and analyze whether it would be possible to deliver the same level of service, but consume fewer indirect resources, or find a way to reduce the per-unit-cost-driver cost of some of those indirect resources. Making these operational improvements can help Fancy Doors to reduce costs, become more competitive, and reduce prices to gain further market share while increasing its profits.