|

|

|

Most fungi that pathogenically affect humans live in soil. If a person is not healthy, has an open wound, or is immunocompromised, a fungal infection can be very aggressive.

More than 30% of American adults, and about 12% of children utilize health care approaches that were developed outside of conventional medicine.

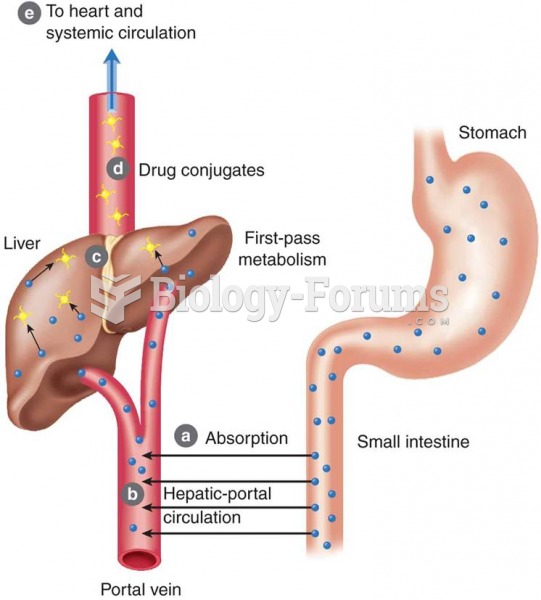

There are major differences in the metabolism of morphine and the illegal drug heroin. Morphine mostly produces its CNS effects through m-receptors, and at k- and d-receptors. Heroin has a slight affinity for opiate receptors. Most of its actions are due to metabolism to active metabolites (6-acetylmorphine, morphine, and morphine-6-glucuronide).

Illicit drug use costs the United States approximately $181 billion every year.

Approximately 500,000 babies are born each year in the United States to teenage mothers.