Answer to Question 1

B

Explanation: B) Under the Fair Credit Reporting Act, consent is required to obtain credit information on individuals. Specifically, this law prohibits the following actions:

Using false, fictitious, or fraudulent statements or documents to get customer information from a financial institution or directly from a customer of a financial institution.

Using forged, counterfeit, lost, or stolen documents to get customer information from a financial institution or directly from a customer of a financial institution.

Asking someone to get another person's customer information using false, fictitious, or fraudulent statements or using forged, counterfeit, lost, or stolen documents.

Answer to Question 2

Note: In some print versions of the text, the second column heading appears as Ending Balance 12/31. The second column heading in the problem should be Ending Balance 12/30 and not Ending Balance 12/31.

1. Adjusting entry for 12/31 payroll.

(a) Work-in-Process Control 4,300

Manufacturing Department Overhead Control 1,400

Wages Payable Control 5,700

To recognize payroll costs

(b) Work-in-Process Control 4,730

Manufacturing Overhead Allocated 4,730

To allocate manufacturing overhead at 110

4,300 = 4,730 on 4,300 of direct manufacturing

labor incurred on 12/31

Note: Students tend to forget entry (b) entirely. Stress that a budgeted overhead allocation rate is used consistently throughout the year. This point is a major feature of this problem.

2. a-e An effective approach to this problem is to draw T-accounts and insert all the known figures. Then, working with T-account relationships, solve for the unknown figures. Entries (a) and (b) are posted into the T-accounts that follow.

Materials Control

Beginning balance 12/1

Purchases 2,100

66,300 59,900a Materials requisitioned

Balance 12/30 8,500

a 2,100 + 66,300 8,500 = 59,900

(a) Direct materials requisitioned into work in process during December equals 59,900 because no materials are requisitioned on December 31.

Work-in-Process Control

Beginning balance 12/1

Direct materials 59,900

Direct manf. labor 84,000b

Manf. overhead

allocated 92,400b 6,700

236,300 234,000 Cost of goods manufactured

Balance 12/30 9,000

(a) Direct manuf. labor 12/31 payroll 4,300

(b) Manuf. overhead allocated 12/31 4,730c

Ending balance 12/31 18,030

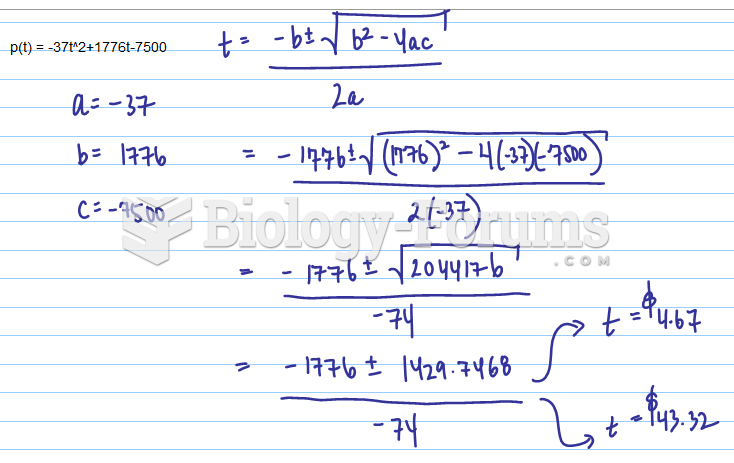

b Direct manufacturing labor and manufacturing overhead allocated are unknown. Let x = Direct manufacturing labor up to 12/30 payroll, then manufacturing overhead allocated up to 12/30 payroll = 1.10x

Use the T-account equation and solve for x:

6,700 + 59,900 + x + 1.10x 234,000 = 9,000

2.10x = 9,000 6,700 59,900 + 234,000 = 176,400

x =

Direct manufacturing labor up to 12/30 payroll = 84,000

Manufacturing overhead allocated up to 12/30 = 1.10 84,000 = 92,400

Total direct manufacturing labor for December = 84,000 + 4,300 (direct manufacturing labor for 12/31 calculated in requirement 1) = 88,300

Total manufacturing overhead allocated for December = 92,400 + 4,730c = 97,130

c 4,300 110 = 4,730, manufacturing overhead allocated on 4,300 of direct manufacturing labor incurred on 12/31.

(b) Total direct manufacturing labor for December = 88,300.

(c) Total manufacturing overhead allocated (recorded) in work in process equals 97,130.

(d) Ending balance in work-in-process inventory on December 31 equals 9,000 + 4,300 (direct manufacturing labor added on 12/31, requirement 1) + 4,730 (manufacturing overhead allocated on 12/31, requirement 1) = 18,030.

An alternative approach to solving requirements 2b, 2c, and 2d is to calculate the work-in-process inventory on December 31, recognizing that because no new units were started or completed, no direct materials were added and the direct manufacturing labor and manufacturing overhead allocated on December 31 were added to the work-in-process inventory balance of December 30.

Work-in-process

inventory

on 12/31 = Work-in-process

inventory on 12/30 + Direct manufacturing labor incurred on 12/31 + Manufacturing overhead allocated on 12/31

= 9,000 + 4,300 + 4,730

= 18,030

We can now use the T-account equation for work-in-process inventory account from 12/1 to 12/31, as follows.

Let x = Direct manufacturing labor for December

Then 1.10x = Manufacturing overhead allocated for December

Work-in-process

inventory

on 12/1 + Direct

materials

added in December + Direct manufacturing labor added in December + Manufacturing overhead allocated in December Cost of goods manufactured in December = Work-in-process inventory on 12/31

6,700 + 59,900 + x + 1.10x 234,000 = 18,030

2.10x = 18,030 6,700 59,900 + 234,000

2.10x = 185,430

x =

Total direct manufacturing labor for December = 88,300

Total manufacturing overhead allocated in December = 1.10 88,300 = 97,130

Finished Goods Control

Beginning balance 12/1

Cost of goods manufactured 4,400

234,000 219,000c Cost of goods sold

Balance 12/31 19,400

c 4,400 + 234,000 19,400 = 219,000

(e) Cost of goods sold for December before adjustments for under- or overallocated overhead equals 219,000:

Cost of Goods Sold

Cost of goods sold 219,000 1,730 (c) Closing entry

Manufacturing Department Overhead Control

Balance through 12/30

(a) Indirect manufacturing labor 12/31 94,000

1,400 95,400 (c) Closing entry

Manufacturing Overhead Allocated

(c) Closing entry 97,130 92,400

4,730 Balance through 12/30

(b) Manufacturing overhead allocated, 12/31

Wages Payable Control

1,400 (a) 12/31 payroll

3. Closing entries:

(c) Manufacturing Overhead Allocated 97,130

Manufacturing Department Overhead Control 95,400

Cost of Goods Sold 1,730

To close manufacturing overhead accounts and overallocated overhead to cost of goods sold