|

|

|

Did you know?

The Babylonians wrote numbers in a system that used 60 as the base value rather than the number 10. They did not have a symbol for "zero."

Did you know?

Approximately 15–25% of recognized pregnancies end in miscarriage. However, many miscarriages often occur before a woman even knows she is pregnant.

Did you know?

Increased intake of vitamin D has been shown to reduce fractures up to 25% in older people.

Did you know?

Patients who have been on total parenteral nutrition for more than a few days may need to have foods gradually reintroduced to give the digestive tract time to start working again.

Did you know?

It is believed that humans initially contracted crabs from gorillas about 3 million years ago from either sleeping in gorilla nests or eating the apes.

As in this photo from Tampa, Florida, hidden cameras now follow us almost everywhere we go. How do ...

As in this photo from Tampa, Florida, hidden cameras now follow us almost everywhere we go. How do ...

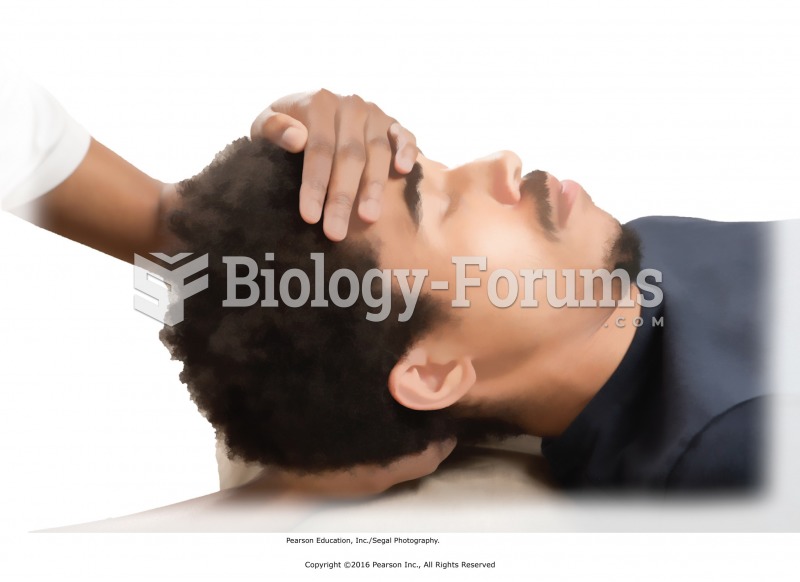

Neck stretch. Rest the receiver’s head on the palm of your right hand, taking a firm hold on the ...

Neck stretch. Rest the receiver’s head on the palm of your right hand, taking a firm hold on the ...