|

|

|

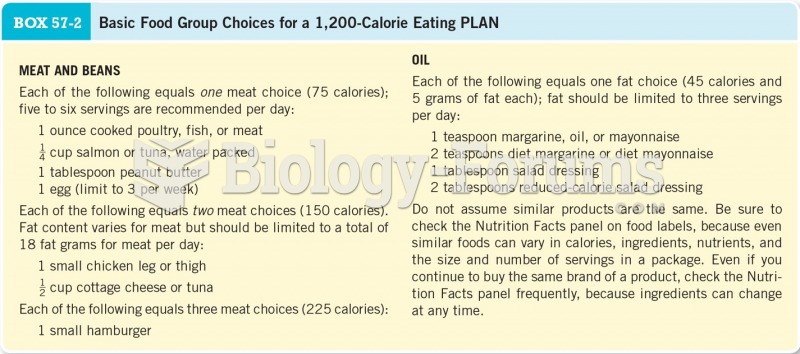

Eat fiber! A diet high in fiber can help lower cholesterol levels by as much as 10%.

Hypertension is a silent killer because it is deadly and has no significant early symptoms. The danger from hypertension is the extra load on the heart, which can lead to hypertensive heart disease and kidney damage. This occurs without any major symptoms until the high blood pressure becomes extreme. Regular blood pressure checks are an important method of catching hypertension before it can kill you.

Human kidneys will clean about 1 million gallons of blood in an average lifetime.

Side effects from substance abuse include nausea, dehydration, reduced productivitiy, and dependence. Though these effects usually worsen over time, the constant need for the substance often overcomes rational thinking.

Excessive alcohol use costs the country approximately $235 billion every year.