Answer to Question 1

TRUE

Answer to Question 2

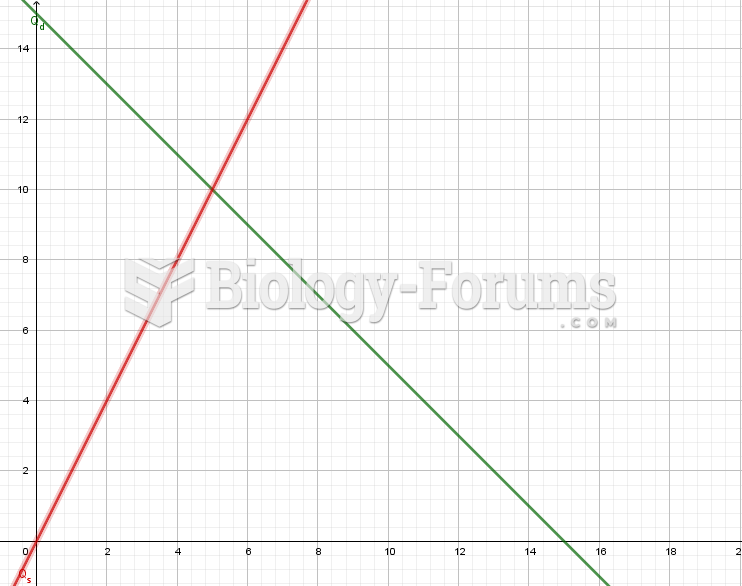

A great deal of debate revolves around the issue of whether markets themselves are efficient or inefficient in forecasting exchange rates. A market is efficient if prices of financial instruments quickly reflect new public information made available to traders. The efficient market view thus holds that prices of financial instruments reflect all publicly available information at any given time. As applied to exchange rates, this means that forward exchange rates are accurate forecasts of future exchange rates.

A forward exchange rate reflects a market's expectations about the future values of two currencies. In an efficient currency market, forward exchange rates reflect all relevant publicly available information at any given time; they are considered the best possible predictors of exchange rates. Proponents of this view hold that there is no other publicly available information that could improve the forecast of exchange rates over that provided by forward rates. To accept this view is to accept that companies do waste time and money collecting and examining information believed to affect future exchange rates. But there is always a certain amount of deviation between forward and actual exchange rates. The fact that forward exchange rates are less than perfect inspires companies to search for more accurate forecasting techniques.

The inefficient market view holds that prices of financial instruments do not reflect all publicly available information. Proponents of this view believe companies can search for new pieces of information to improve forecasting. But the cost of searching for further information must not outweigh the benefits of its discovery.

Naturally, the inefficient market view is more compelling when the existence of private information is considered. Suppose a single currency trader holds privileged information regarding a future change in a nation's economic policyinformation that she believes will affect its exchange rate. Because the market is unaware of this information, it is not reflected in forward exchange rates. The trader will no doubt earn a profit by acting on her store of private information.