Answer to Question 1

The taxation of e-commerce illustrates the complexity of the governance and jurisdictional issues in the global economy. Most of the issues surround the sales tax imposed by various states or countries on products sold to residents of their state or country. Governments the world over rely on sales taxes to fund various types of government initiatives and programs including the building of roads, schools, and sewers or other utilities to support business development.

In the United States, between the fifty states and the multiple counties and municipalities, there are thousands of different tax rates and policies. For example, in some states food is not taxed at all and there are a myriad of different exceptions and inclusions depending on the locality. However, with the rise of e-commerce and virtual storefronts, the question is raised as to what locale a virtual storefront is considered to be located in. The development of MOTO (mail order/telephone) retail in the 1970s began the discussion on the taxing of remote sales. State and local tax authorities wanted MOTO retailers to collect taxes based upon the address of the recipients, but the Supreme Court has ruled that states cannot force MOTO retailers to collect taxes unless the business has a physical presence in the state. Legislation to the contrary has never been able to garner sufficient support in Congress due to pressure from the catalog merchants, leaving intact an effective tax subsidy for MOTO merchants.

The explosive growth of e-commerce, the latest type of remote sales, has raised the issue of how and if to tax remote sales. Since its inception, e-commerce has benefited from a tax subsidy of up to 13 for goods shipped to high sales tax areas. Local retail merchants have complained bitterly about the e-commerce tax subsidy. E-commerce merchants have argued that this form of commerce needs to be nurtured and encouraged, and that in any event, the crazy quilt of sales and use tax regimes would be difficult to administer for Internet merchants. Online giants like Amazon claim they should not have to pay taxes in states where they have no operations because they do not benefit from local schools, police, fire, and other governmental services. State and local governments meanwhile see billions of tax dollars slipping from their reach. As Amazon's business model has changed with its building of large distribution centers close to urban areas to enable next-day delivery, so has its opposition to paying sales taxes softened.

Answer to Question 2

TRUE

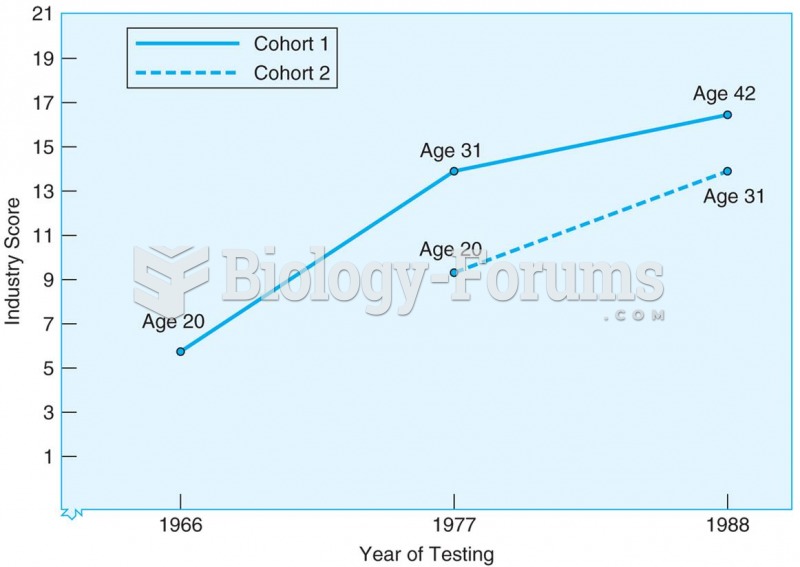

Results from sequential study of two cohorts tested at three ages and at three different points in t

Results from sequential study of two cohorts tested at three ages and at three different points in t

Hong Kong is a strange situation. A British colony since 1842, it was handed back to China in 1997 a

Hong Kong is a strange situation. A British colony since 1842, it was handed back to China in 1997 a