|

|

|

Human stomach acid is strong enough to dissolve small pieces of metal such as razor blades or staples.

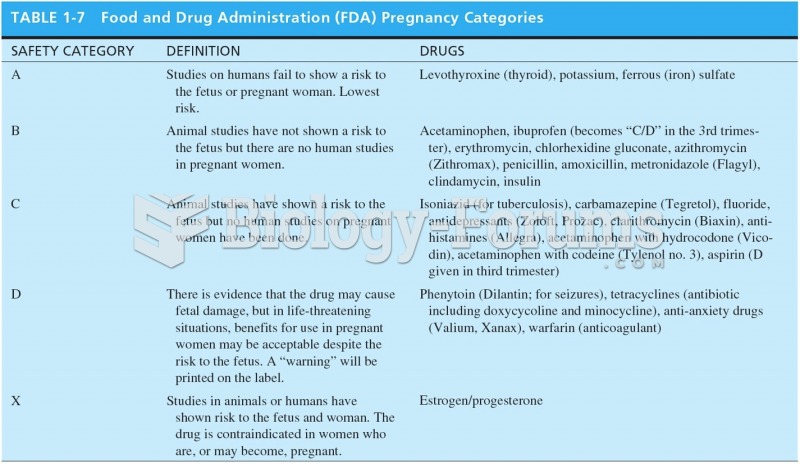

Aspirin may benefit 11 different cancers, including those of the colon, pancreas, lungs, prostate, breasts, and leukemia.

A strange skin disease referred to as Morgellons has occurred in the southern United States and in California. Symptoms include slowly healing sores, joint pain, persistent fatigue, and a sensation of things crawling through the skin. Another symptom is strange-looking, threadlike extrusions coming out of the skin.

Cancer has been around as long as humankind, but only in the second half of the twentieth century did the number of cancer cases explode.

Increased intake of vitamin D has been shown to reduce fractures up to 25% in older people.