|

|

|

There can actually be a 25-hour time difference between certain locations in the world. The International Date Line passes between the islands of Samoa and American Samoa. It is not a straight line, but "zig-zags" around various island chains. Therefore, Samoa and nearby islands have one date, while American Samoa and nearby islands are one day behind. Daylight saving time is used in some islands, but not in others—further shifting the hours out of sync with natural time.

Interferon was scarce and expensive until 1980, when the interferon gene was inserted into bacteria using recombinant DNA technology, allowing for mass cultivation and purification from bacterial cultures.

The newest statin drug, rosuvastatin, has been called a superstatin because it appears to reduce LDL cholesterol to a greater degree than the other approved statin drugs.

As of mid-2016, 18.2 million people were receiving advanced retroviral therapy (ART) worldwide. This represents between 43–50% of the 34–39.8 million people living with HIV.

Asthma attacks and symptoms usually get started by specific triggers (such as viruses, allergies, gases, and air particles). You should talk to your doctor about these triggers and find ways to avoid or get rid of them.

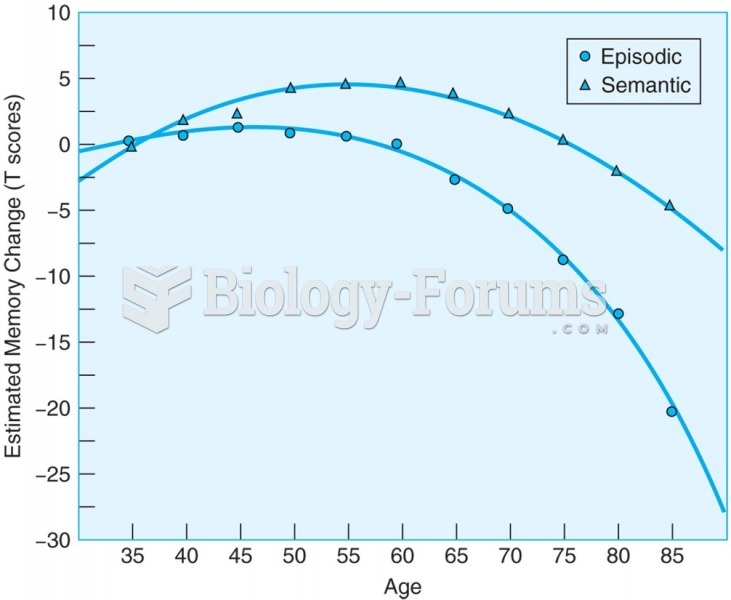

Estimated age-related changes in semantic and episodic memory abilities. Semantic memory abilities ...

Estimated age-related changes in semantic and episodic memory abilities. Semantic memory abilities ...

Targeting female fetuses for abortion has become a main issue of the emerging feminist movement in ...

Targeting female fetuses for abortion has become a main issue of the emerging feminist movement in ...